You are finally making the money you’ve worked for so long to make. Climbing the Corporate ladder has paid off. That business venture you took a risk on is reaching its stride. Your ship has come in!

You’re making more money than ever before. Things are looking up!

However, you check the bank account, and it feels like you should have more saved than you do. It feels like you should be farther ahead than you are. “I am making more money than ever,” you tell yourself, yet it feels in some ways harder than ever.

Each month is different. Some months are exceptional, and you play catch up or finally take that vacation you’ve put off for so long. Other months feel like you are barely scraping by. Sound familiar?

For many, this is the life of someone with variable income.

Everyone’s situation is different, especially when it comes to variable income, and it can be a real challenge to plan for and use to your advantage. Below are a few steps that should go a long way to providing clarity.

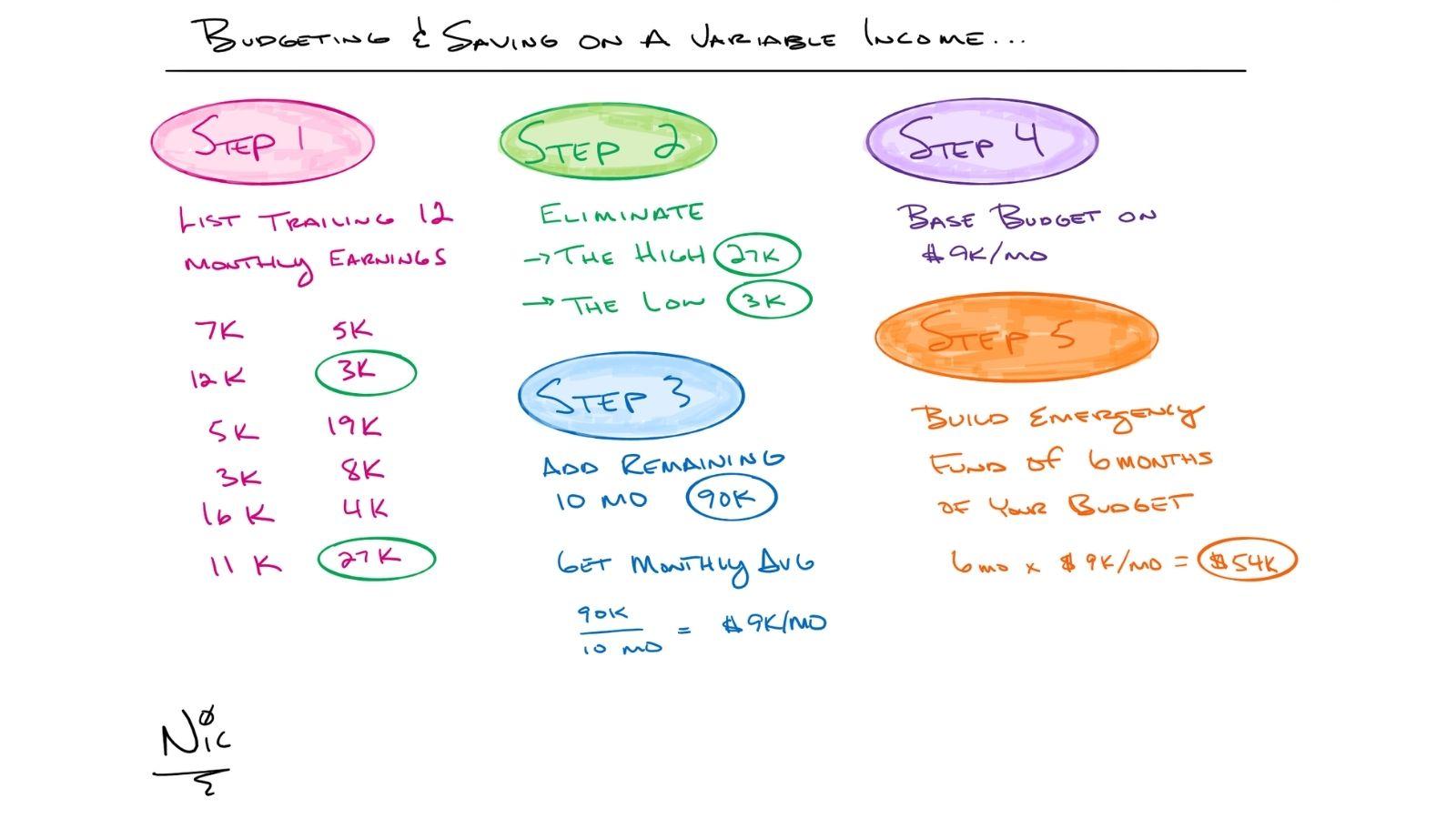

Step 1: Make a list of your monthly earning.

You should have 12 numbers here, assuming you’ve been on the variable income train that long. If not, do your best to list an accurate number, even if it’s just six months.

Step 2: Eliminate the top and the bottom monthly earning.

Sure, that big month you had felt tremendous but let’s be more conservative when we set a framework moving forward. Also, your worst month isn’t an accurate representation either. So we will eliminate both extremes to get a good working number.

Step 3: Add the remaining 10 months up & divide by 10.

Is it higher than you thought? Lower? This number is just the baseline, so don’t freak out either way.

Step 4: Base Budget is equal to the result of Step 3

In this example, the numbers work out to $9,000 a month. So make sure you aren’t living too high on the hog, so you aren’t stressed to make this average work.

Step 5: Build an emergency fund equal to 6 months of your budget.

Hitting that 6-month goal may take time, depending on how much you already have saved. There are numerous ways to make this work. You can deposit your income into an “emergency fund” to automatically pay yourself a paycheck a few times a month. This system can work wonders, assuming you have enough buffer to start.

Another quick tip is to have one “income” checking account where all income flows. You manually disperse it by percentage twice a month into different accounts such as savings, spending, and bills.

Variable income might take some getting used to, but it doesn’t have to prevent you from getting ahead.

IMPORTANT DISCLOSURES

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

LPL Tracking #1-05132408