Why do people like to save for future income using life insurance? Primarily it is the premise of borrowing from your policy and taking tax free loans. It everything works out according to plan, you borrow funds during your lifetime and when you pass away, your beneficiaries receive the death benefit federally and state tax free.

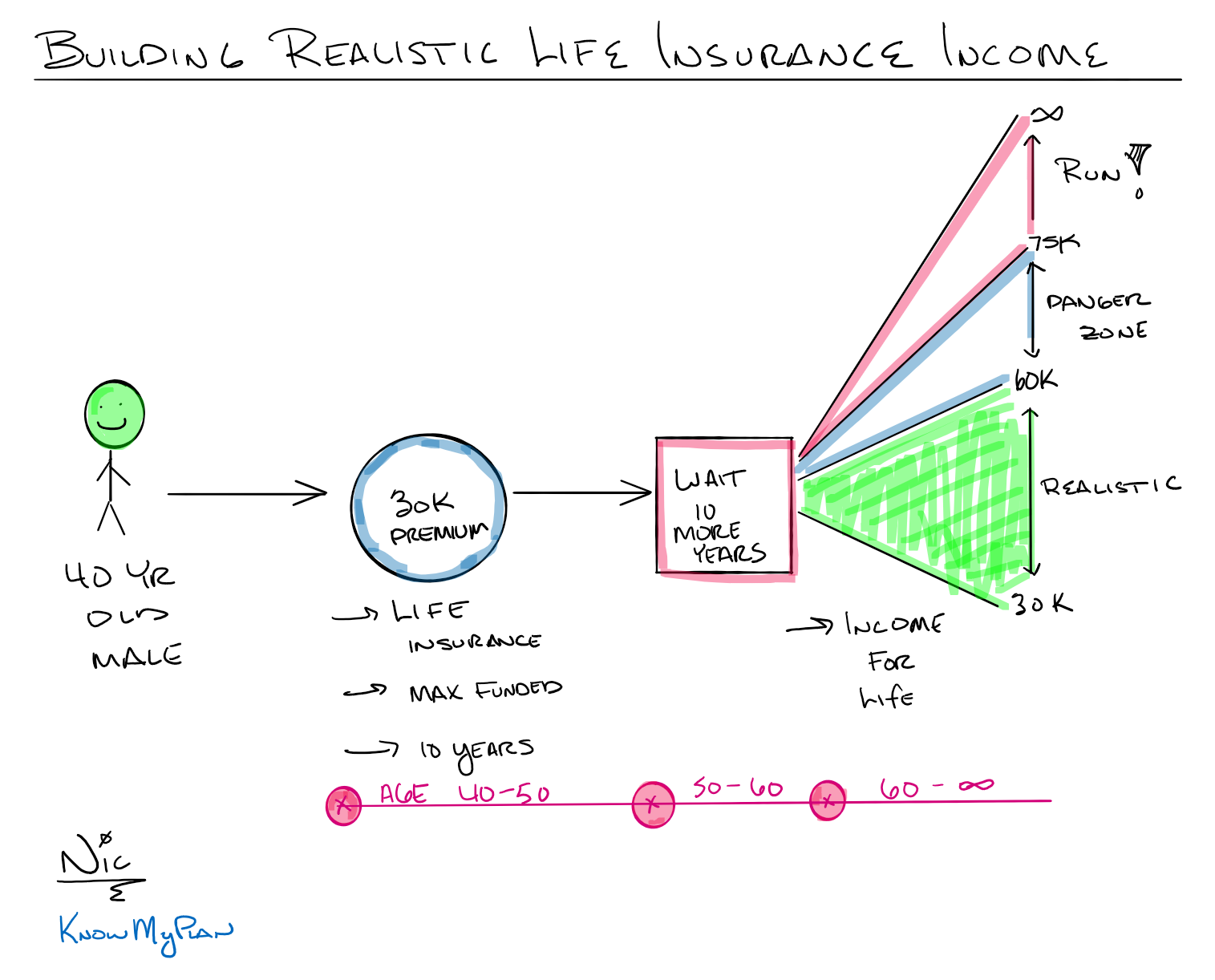

Considerable the example of a health 40-year-old male who would like to make 30k premium payments per year over the next 10 years. He would then like to wait 10 years and then take income starting at age 60.

It would be reasonable to expect annual income in the 30-60k/ year range. If you see an illustration outside of this range, be very careful. The illustrations can be extremely complicated.

Recently, I have seen some extreme illustrations that seem too good to be true. The adage almost always holds up with any sort of savings plan, if it seems too good to be true, it probably is.

Please note:

Keep in mind that both loans and withdrawals from a permanent life insurance policy may be subject to penalties and fees and, along with any accrued loan interest, will reduce the policy’s account value and death benefit.

Withdrawals are taxed only to the extent that they exceed the policy owner’s cost basis in the policy. A policy loan could result in tax consequences if the policy lapses or is surrendered while a loan is outstanding.

#financialplanning #charlotte #medicaldevicesales #executivesandmanagement

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. This is a hypothetical example and is not representative of any specific investment. Your results may vary.

LPL Tracking #1-05180451