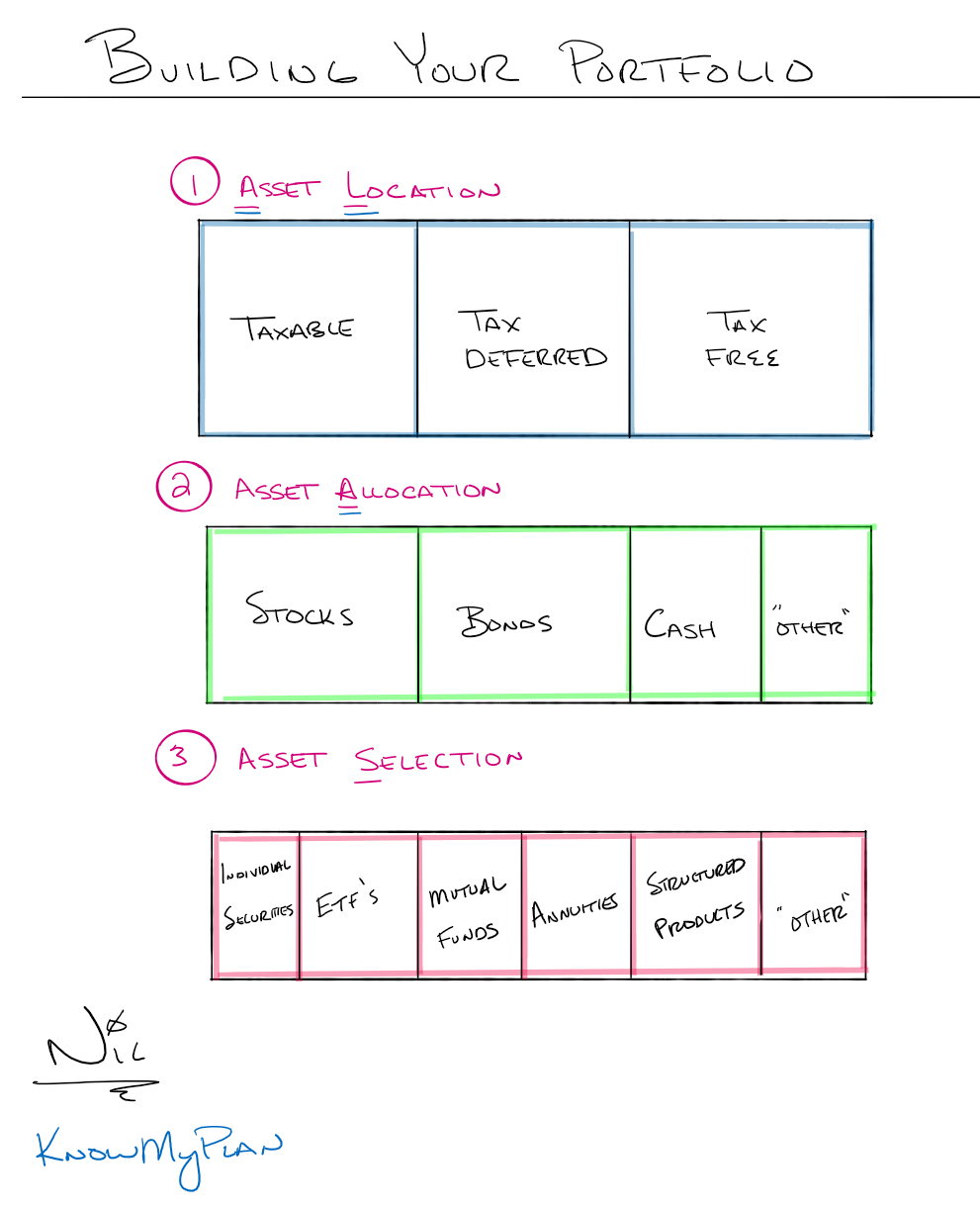

Building a portfolio? Where do you start? Turn on the TV, or do a quick search and you’re hit with a mountain of information. Not only is the amount of information staggering, how do you know who is right? Likewise, it’s easy to get sucked into the hype. Everyone wants to get in on the latest meme stocks right? ‘Sexy’ should be the last thing to consider when thinking about your investments. There are 3 main considerations in building your portfolio: Asset location, allocation, and selection. Amateur’s start with asset selection. Professionals start with asset location.

Location, location, location

Too often, investors fail to consider the importance of taxes. Your 10% return doesn’t look so hot if you didn’t anticipate taxes. Starting with asset location helps mitigate this risk. Most investors can benefit from owning assets in the taxable, tax-deferred, and tax-free buckets. Do you pay taxes now? Later? Perhaps a little along the way? Taxes change, so you want more options when in retirement. We say, “there’s no crystal ball” for predicting what the market will do. This idea is just as true for tax rates, there is no way to predict where they will be when you retire. The remedy is to spread your dollars across the taxable, tax-deferred, and tax-free buckets.

Don’t just be a saver

Asset allocation is a fancy way to explain what big-picture categories of investments you’re holding like stocks, bonds, and real estate. Asset allocation has arguably the greatest effect on your rate of return. Would you want 100% of your money in a savings account? Likewise you won’t likely abandon your checking account to go all in on equities. Getting the proper mix of assets in your overall portfolio is an important decision.

What now?

Now the fun stuff. Picking the individual securities, ETFs, funds, bonds etc. can be challenging since none of us have a crystal ball. Things change and investors need to be ready for almost anything. Knowing when to make changes can be tough. Having a financial professional in your corner can make all the difference.

Always start with location, then allocation and then finally the selection for your individual plan.