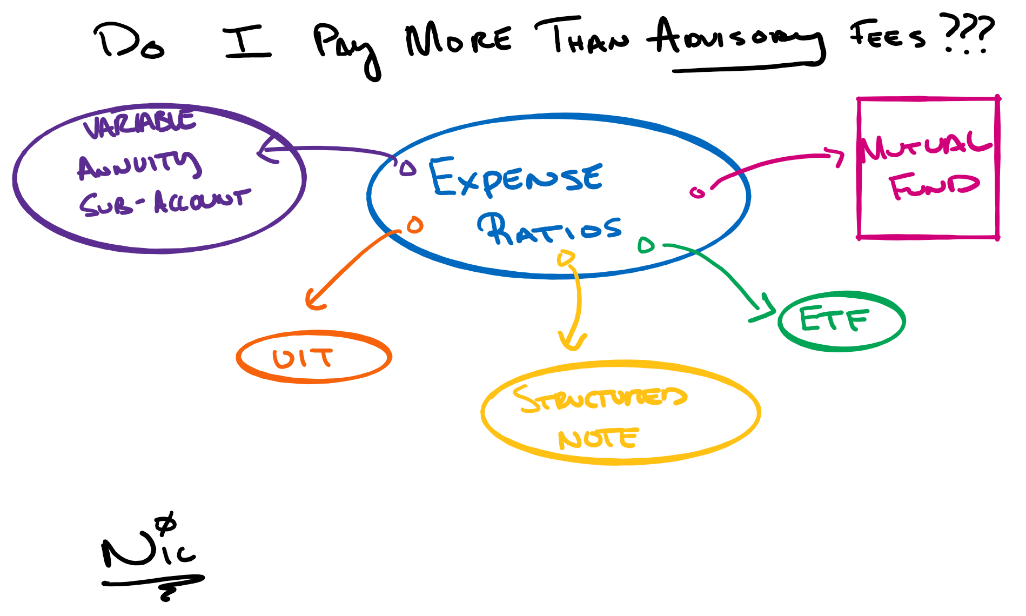

Unless your financial planner has selected individual securities (stocks & bonds) or certain annuities (fixed or fixed indexed), the answer is probably yes.

It’s important to understand “expense ratios.”

High expense ratios aren’t necessarily evil and low expense ratios aren’t necessarily good, but I believe they are important to understand in an overall framework of cost.

For example, Bill might have an advisory relationship where he pays an advisory fee of 0.80% of assets under management, but has expense ratios that average 0.70%. Bill’s total costs are 1.50%.

Ted might have an advisory relationship where he pays an advisory fee of 1.00% of assets under management, but has expense ratios that average 0.10%. Ted’s total costs are 1.10%.

Focusing only on the advisory fee is kind of like looking to buy a new home, but only focusing on the HOA dues.

The good news is that the most widely held packaged products (mutual funds and ETF’s) are really easy to look up their expense ratios thru a quick Google search.

⏰ NOTE: This doesn’t mean that Ted’s advisor is better than Bill’s or that Bill is receiving better advise than Ted. I just think everyone deserves a straightforward conversation on cost.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.