What is your largest asset? 401k? House? For most, your greatest asset during your working years is your ability to earn an income. Yet, many go without protecting their income should they become disabled.

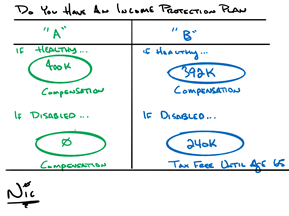

I want to share with you an example of two people both making $400k annually. Person “B” takes 2% of their salary ($8,000) and purchases a disability insurance policy. In this example, the disability policy will pay out $240k per year tax free until he reaches age 65.

Why does Person “B” receive the disability insurance payments tax free? Because Person “B” made the premium payment with after-tax money.

It’s not just horrific accidents that lead to people needing disability insurance. The leading claims are back injuries, cancer, heart attacks, and diabetes.

Potential reasons to own an individual disability policy instead of group:

???? Add cost of living adjustments

???? Keep the coverage when you change jobs

???? Control. If you pay the premiums, you have coverage. Your employer could terminate its group plan at any time.

???? If you pay the premiums, the benefits are tax free. If your employer pays the premiums, the benefits are taxable.

NOTE: Make sure you work with a professional to get a policy that in non-cancellable.

Can you set aside approximately 2% of your compensation to provide 60% of your compensation to be received tax free until age 65?

Can you afford not to?

Remember, this is a way to transfer risk. Hopefully, you reach age 65 and you never receive a disability insurance payment. This means that you are alive and presumably healthy.

This material contains only general descriptions and is not a solicitation to sell any insurance product or security, nor is it intended as any financial or tax advice. For information about specific insurance needs or situations, contact your insurance agent.

Please keep in mind that insurance companies alone determine insurability and some people may be deemed uninsurable because of health reasons, occupation, and lifestyle choices.

Guarantees are based on the claims paying ability of the issuing company.