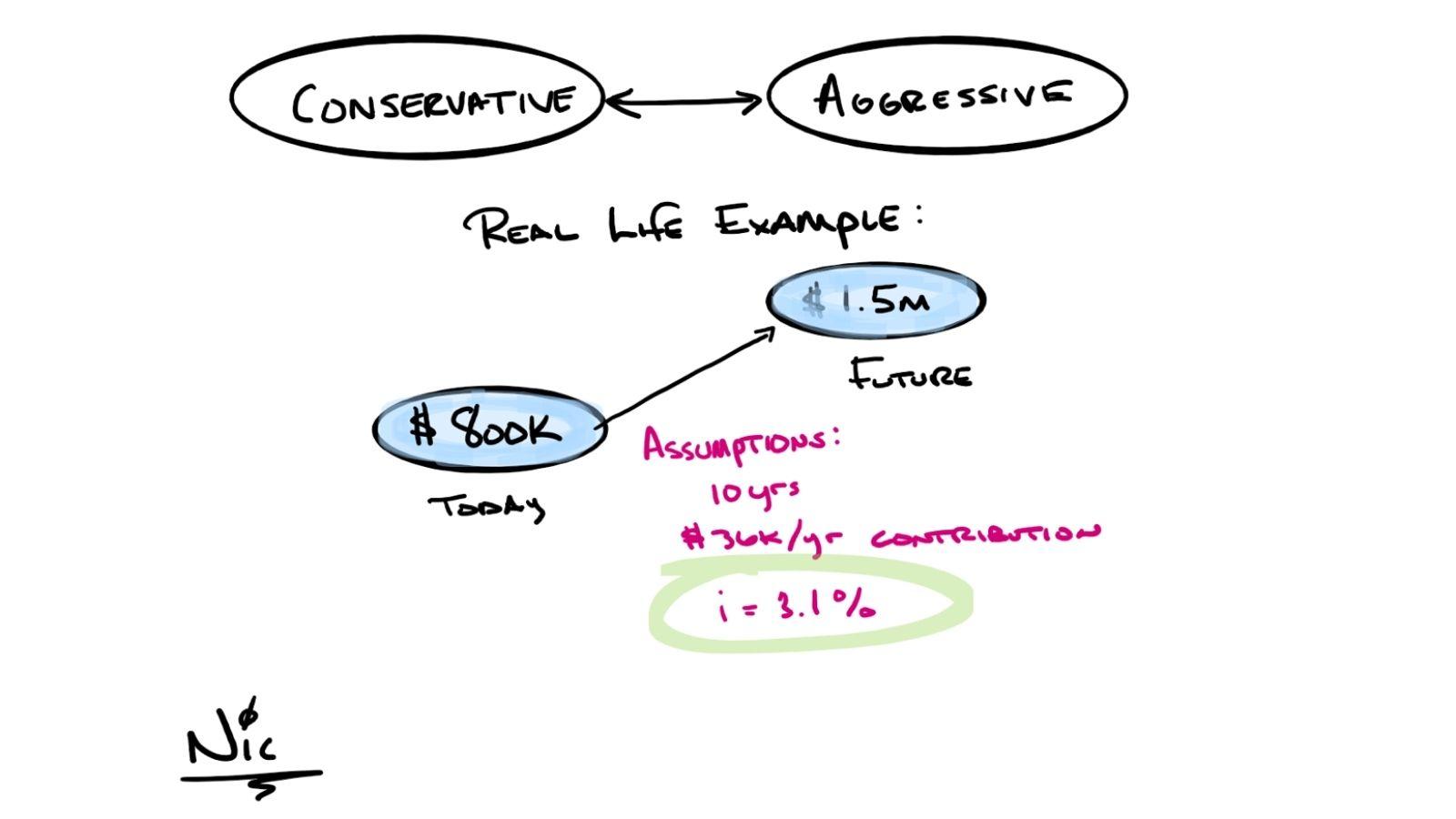

Consider the family that has a dream to be financially independent in 10 years.

Their financial planner determined that their magic number was $1.5 million through careful precision. Currently, they have $800k saved and are committed to saving $36k/year or $3k/month.

How conservative versus how aggressive should you be?

First, let us calculate the rate of return needed to go from $800k to $1.5m with a $36k annual contribution. The result turns out to be 3.1%

- Is the idea of achieving your dreams to do so with the least possible risk?

- Is the idea of achieving your dreams worth taking on more risk?

To set the stage a bit, needing just a 3.1% rate of return to achieve this goal is undoubtedly on the lower and more achievable end of the spectrum.

So, the idea of “taking on more risk” in this scenario is not like taking on more risk by putting half of your portfolio in crypto and hoping for the best.

It might mean slightly more equity exposure, as an example.

The worst 20-year rolling rate of return in equities was 6% per year (the best was 17%). So with that in mind, there is a chance to reach the goal even sooner. Conversely, you could also arrive at your ten-year goal with a larger than anticipated nest egg.

Despite the rosy rate of return conversation, potentially taking on more risk could keep you from achieving this dream of financial independence in 10 years. Your risk exposure could provide negative returns, and you might have to save more or delay this gratification. However, taking on additional risks could unlock other dreams. The only certainty is that your financial plan will need to be changed and regularly monitored.

With any financial planning, there are numerous variables at play that constantly change, like changing your mind on how your retirement should look. That’s ok! Working with a Financial Planner can go a long way to alleviating your retirement woes and lowering your stress along the way.

IMPORTANT DISCLOSURES

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss.

LPL Tracking #1-05137530