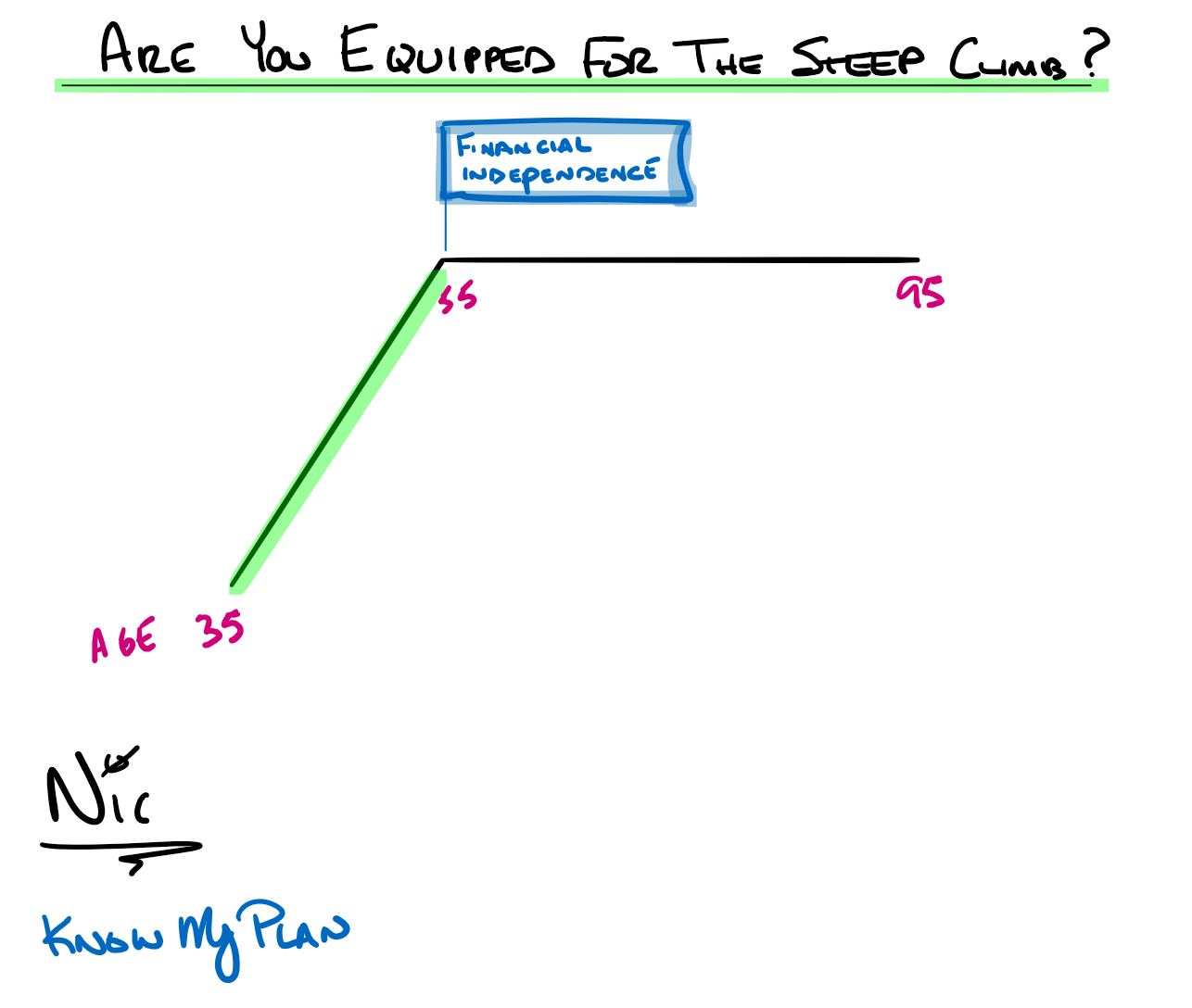

This year, I have been blown away by how many people want to become financially independent at a young age. Between the ages of 50 and 55, I hear the most from when people want to make work optional.

This means that you are a short time to save and prepare to become financially independent. Therefore, saving is now a sprint and not a marathon.

Keys to success:

- High savings rate

- Eliminate debt (outside of your mortgage)

- Live within your means

- Pay close attention to your fitness (diet and exercise)

- Own investments in the best companies in America & the World.

As you can imagine, if you walk away from a job, there is a chance you are looking at a 40-year-plus “retirement.”

A rule of thumb

Thankfully the 4% rule historically holds up nicely even for conditions like this. A study with a portfolio of 50% stocks and 50% bonds looked at many scenarios to determine that 4% is a ‘safe withdrawal rate.’ For example, that means that if you have $1 million in retirement, you can safely take $40,000 a year.

However, the above is a gross oversimplification, and there are many factors to consider, like what the market is doing when you retire, inflation, interest rates, etc.

That said, what if things go better than expected? The 4% rule is based on a 50/50 mix of stocks and bonds. What if, instead, you used a 75/25 split having more stocks? Perhaps a pension exists? What if you take on some consulting work in the early years of early retirement?

Stay committed; you can do it

Yes, a high savings rate is mandatory, and the higher the savings rate, the earlier you can step away. For those looking to explore early retirement, it is essential to remember that it is unlikely that you will step away from work at age 50 and never to earn another dollar again. Perhaps you can start that passion project or do some part-time work in the non-profit sector and bring in some dollars to take the pressure off your portfolio and bring more joy into your life. In short, being open-minded about life after early retirement can bolster your financial plan in new and exciting ways, perhaps giving you the freedom you crave, sooner!

Source: (Trinity Study, 1998)https://en.wikipedia.org/wiki/Trinity_study