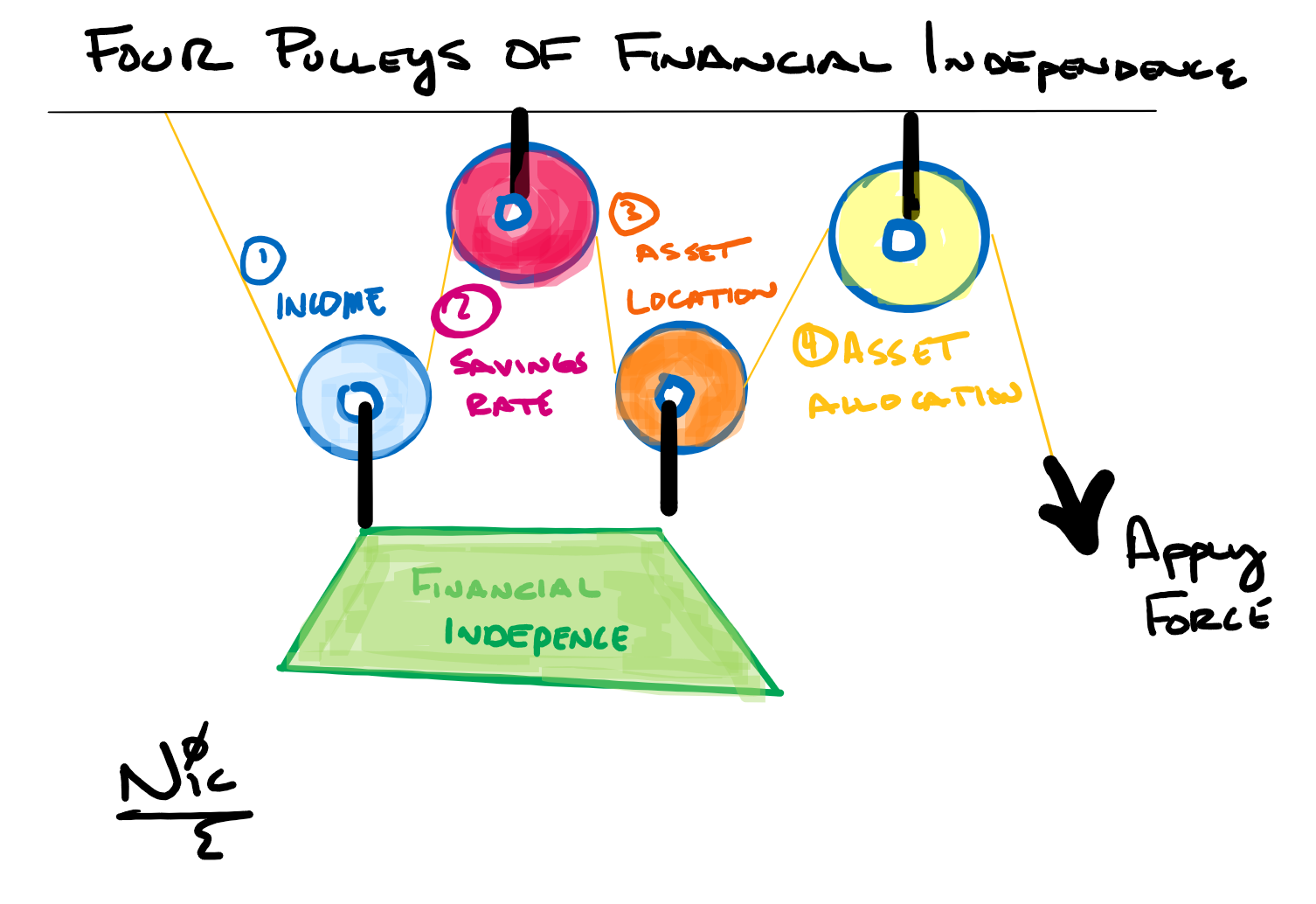

There are four main levers for building wealth. You can absolutely build wealth by focusing solely on one of the pulleys. However, you can have a greater opportunity to build wealth faster or ultimately build more wealth, by simultaneously incorporating all four pulleys.

???? Income – focus on activities that can increase your earnings power.

???? Savings Rate – as your income grows, make it a goal to increase your savings rate.

???? Asset Location – focus on where you are saving your money. Personally, I love “All Things Roth.” Check out your 1099’s to elevate your interest, dividends, & capital gains. Are there ways to become more tax efficient?

???? Asset Allocation – Be diversified. Focus on owning the best companies in America & The World. Asset allocation is the process of spreading your money across different types of investments (cash-real estate-bonds-stocks-etc..).

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.