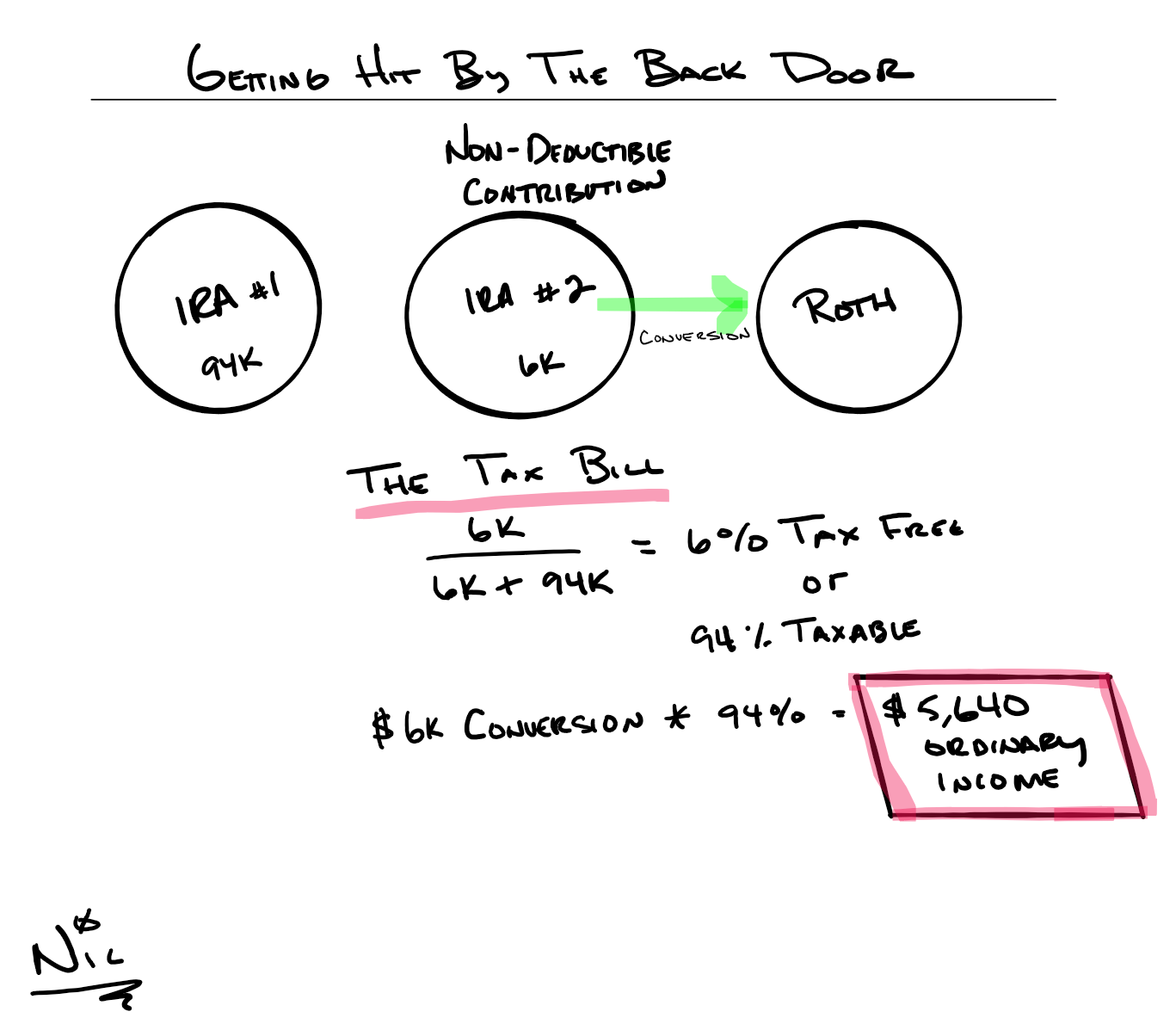

The Back Door IRA is incredibly popular. If you aren’t familiar with the strategy, it is essentially this:

???? You contribute to a non-deductible IRA

???? You wait a nominal amount of time & then convert the non-deductible IRA to a Roth.

If you do not have a Traditional (deductible) IRA, this is very straightforward.

If you do have a Traditional IRA, you have to aggregate the value of ALL of your IRA’s to determine how much of the conversion is taxable.

If this still doesn’t make sense, ask for help!

???? Friends don’t let friends do Roth conversions alone.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.