The International Capital Market Association estimates that the global bond market is approximately $128 trillion. By this point, I think we are all aware that we are in a low interest rate world. People are refinancing their 30yr mortgages for 3% or less. You can buy a new vehicle and finance it generally for less than 3%.

Historically, this is an amazing time to borrow money.

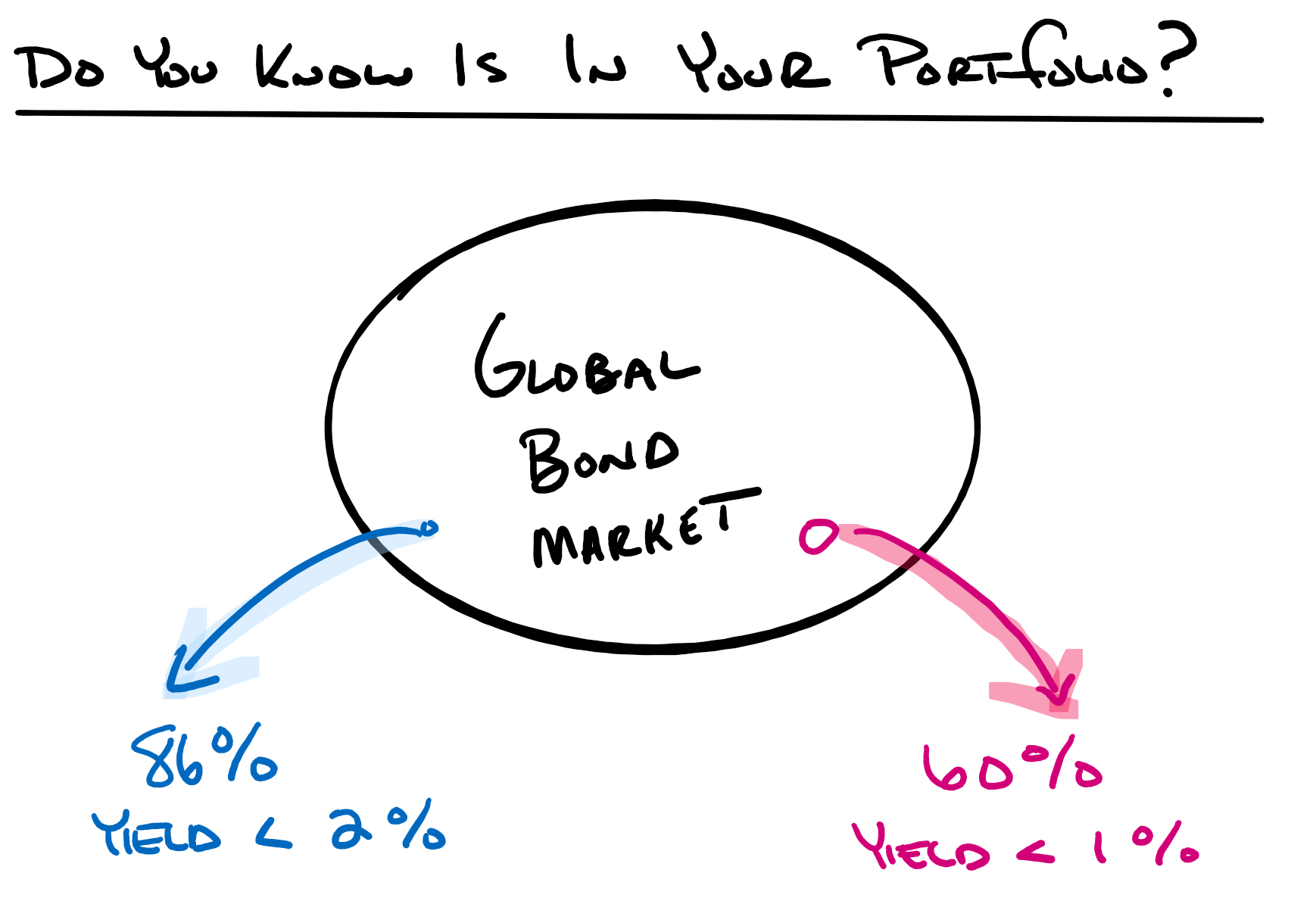

However, the flip side of a low interest rate environment is what is happening in the global bond market.

❌ 86% of global bonds now yield less than 2%

❌ 60% of global bonds now yield less than 1%

Some bonds can be great diversifiers to zig when the market zags. However, many bonds move very closely to the stock market. You need to be very intentional if you want to own fixed income investments for the purpose of diversification.

Remember, Target Date Funds (often found within your retirement plan) are designed to get more conservative (by adding bonds) as you age.

Know what you own, why you own it, & where it fits into your financial picture.

Nic Note: The global bond market is actually much larger than the global stock market.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

SOURCE: https://www.ft.com/content/b44281c0-2ddb-46ae-83e2-150461faed65

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.