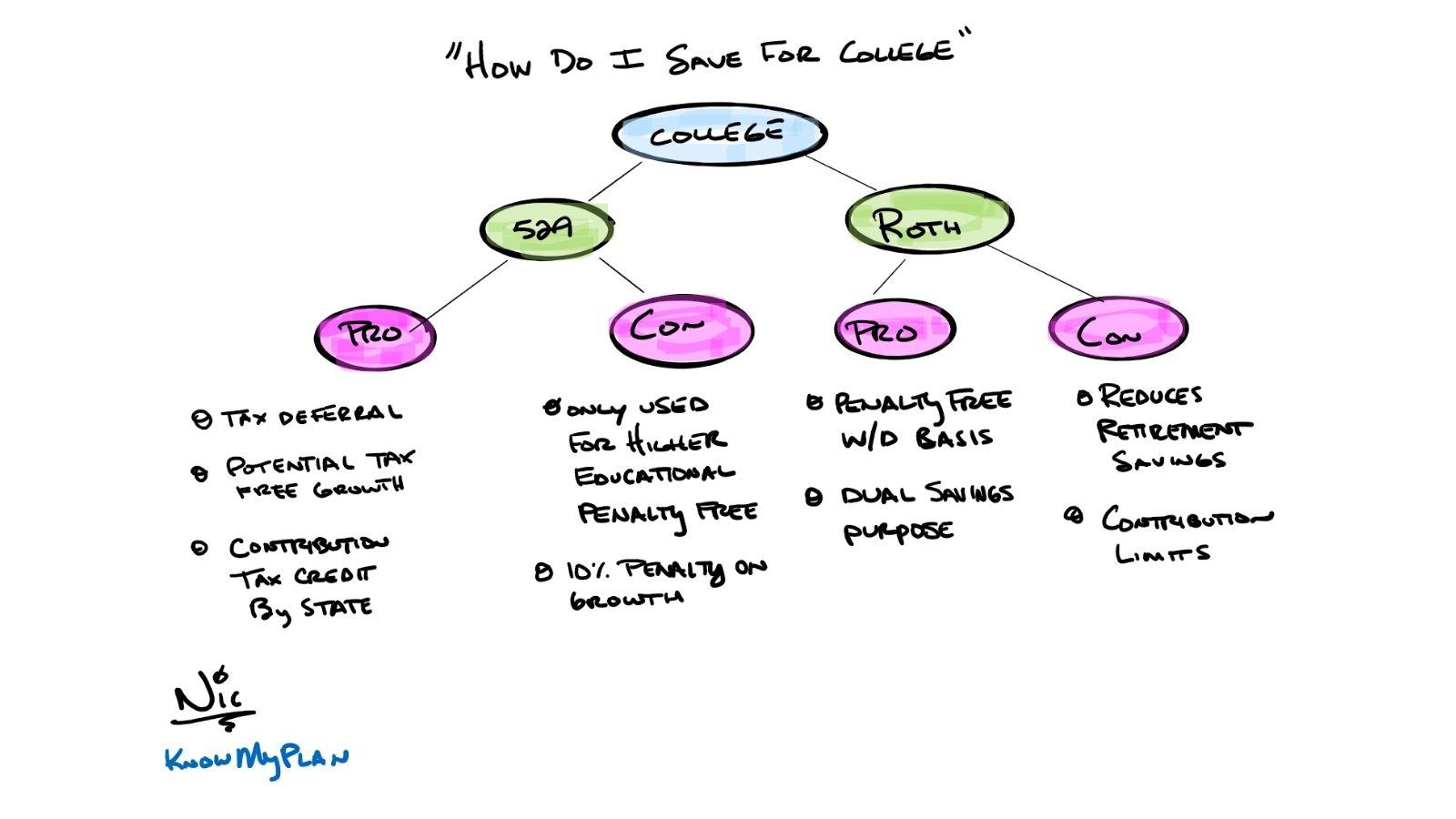

There are two popular paths for college savings: a 529 savings plan or a Roth IRA. There are some accounts that I tend to shy away from (UTMA, UGMA, ESA’s, & Cash Value Life Insurance) for college purposes.

Depending upon the situation and risk tolerance, cash value life insurance could work if designed correctly. The secret is to start saving when the child is very young.

Your core team

The 529 is very efficient when used for qualified educational expenses. I believe it is the superior option to save for college.

There’s a downside for sure. If you use the funds for unqualified educational expenses, there’s a 10% penalty on the gains. Also, the distribution gets taxed as ordinary income.

Honestly, it is not the worst thing in the world because funds have tax-deferred growth potential, and you are not getting an annual 1099 for interest and dividends like you would in a taxable account.

Conversely, the Roth IRA can help you hedge against the concern of the funds not being used for qualified educational expenses. When comparing the two investment vehicles, many considerations arise; individual limits, annual gift tax, multiple contributors, Roth earned income limits, etc.

For the earnings to be tax-free, however, you need to keep two things in mind. You must hold the account for five years or wait until age 59 1/2 to make a withdrawal, whichever is later. The Roth IRA allows for the distribution of your contributions any time, penalty-free.

The downside of using the Roth IRA for college is that it depletes your future tax-free income in retirement.

An unstoppable duo

Consider using the Roth IRA to compliment the 529 Plan. Also, if you have access to Super-Fund a Roth IRA (thru annual After-Tax 401k Rollovers, depending on 401(k)plan guidelines), I would prioritize that strategy over 529 Plan contributions. If you have maxed out the Super Roth strategy and still have money to save for college, utilize the 529 Plan.