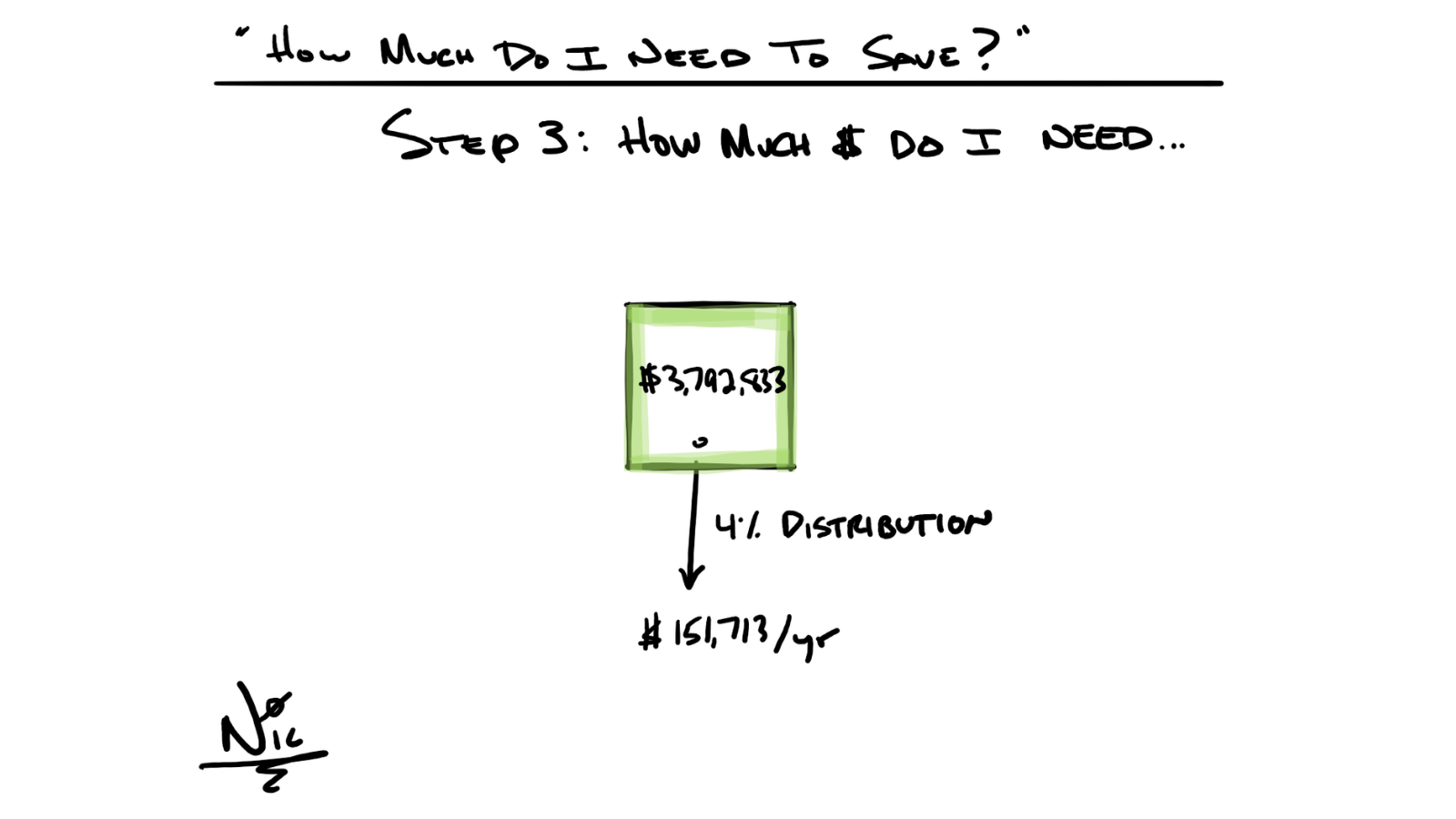

In Step 2, we calculated that we need $151,713 per year from our portfolio to be “financially independent.”

NIC NOTE: I define “financially independent” as the ability to no longer needing to earn income from a job. You might choose to work because you love it, but you no longer have to go to work to build your nest egg.

If we take our annual portfolio need ($151,713) and divide it by an annual distribution rate (.04 or 4% perfect), we get the answer of $3,792,833.

IMPORTANT DISCLOSURES

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

LPL Tracking #1-05134997