You just won the lottery! Now, you have $2 million to your name, well you’ll have to pay taxes, but your ship has come in! Time to tell the boss just what you think about him. You can kiss this job goodbye. Time to punch out for the last time, ever! It’s off to the beach to sip on your umbrella drink of choice as the waves of time wash away all of life’s worries. Financial Independence is the opposite of this.

Financial Independence is when you have enough income from investments that work becomes optional.

In the early ’90s, Vicki Robin and Joe Dominguez wrote Your Money or Your Life. This book would have a significant impact on spreading a message that you can use your money to be in control of your own life through thoughtful spending and investing practices that led to true Independence that didn’t need to wait until your golden years.

It ebbed and flowed, rediscovered, by a handful of bloggers in the late ’00s and early ’10s, who began to reignite the concept, often retiring in their early 30s and 40s. It has morphed into a term called FIRE, which stands for “Financial Independence Retire Early.”

Financial Independence vs. Retire Early

We’ve already defined Financial Independence, so the Retire Early side of things is pretty straightforward. It would apply to those perhaps farther along in age that don’t want to wait until 65 to live life on their terms. Most in this realm typically align with the FI side of things, where we will spend most of our time.

Financial Independence can be a borderline taboo subject. On the one hand, it feels like the ultimate luxury, which I’d argue it is. On the other hand, it feels like something only a privileged few “get to” obtain. Occasionally people will say it’s some exclusive, elitist club. Thankfully it’s quite the opposite.

Financial Independence is for all

Financial Independence is a life optimization strategy to hyper-optimize your finances and life, constantly audit your savings rate to get it as high as possible, and shorten your time to separate the need for employment. It means it’s for everyone. If you are dissatisfied with your job or desire a life with more travel and time freedom, this might interest you.

One of the early pioneers of this modern movement, Jacob Lund Fisk, chronicles his journey of hitting the financial independence milestone while living on $7,000. A lifestyle like that isn’t for everyone, and FI isn’t for everyone, and that’s ok. Sometimes expanding your understanding of “what’s possible” is all that you need to give yourself permission to expand your horizons to live a life you might have only dreamed possible.

As you might already imagine, embarking on a journey like this comes with many challenges and opportunities. To take it seriously means you will undergo a sort of personal development transformation where you are confronting everything you value, from how you spend your free time to where you live, what you drive, and even what you eat. You don’t have to hate your job to go through this exercise, and auditing everything about how you live can be life-changing, albeit time-consuming.

So how does all this work?

Step one is to consider your goals and dreams and what you want out of your life. Think about your why and reasons for going down this path. Now evaluate your expenses and prepare to start cutting! Everything about Financial Independence is working toward growing a nest egg large enough to sustain you for decades while attempting to do this as quickly or efficiently as possible, at least in theory. Just because you could conceivably retire in 10 years by only eating rice and beans, selling your car, and abandoning a social life doesn’t mean you should. Many deep in the weeds on this are comfortable hitting above-average savings rates and retiring in 20 years or less.

The beauty of all of this is it’s up to you. You are in charge of when you hit your number when it comes to things you can control.

There are many paths to FI, but starting with the most prominent will establish a baseline for the rest of this conversation.

The 4% rule

We have to take a step back and understand some investment basics to chart our course. The “4% rule” dates back to the Trinity Study study. The authors ran multiple scenarios (like a lot of them) to find a “safe” withdrawal rate in which an investment portfolio could be sustained for decades at a time or indefinitely. All the data in the study points to 4% being a safe amount of money to withdraw each year from a diversified portfolio that should weather the ups and downs of the market over long periods.

This concept is still the gold standard, though a few things to note before moving forward. First, the portfolio that is the basis for this study is a 50% stock and 50% bond portfolio. Many would conclude that to be quite conservative, though you might make some tweaks to the portfolio given our current low-interest-rate environment. I’ll keep my bias at bay for the sake of laying the groundwork. It’s also worth noting that people don’t always agree that 4% is the number. Some say 3.75%, others think 4.5% is just fine. There are numerous voices in the mix and plenty to consider that would derail this whole article to I’ll leave it here for now.

A paycheck for life

Imagine the scenario of having $1 million in a well-diversified portfolio. According to the 4% rule, you should be able to take a 4% distribution or $40,000 every year indefinitely. 4% assumes some things like getting a 7% return on average with 3% inflation meaning your portfolio will still, in theory, generate the same lifestyle or purchasing power over time.

Once we understand the 4% rule, we can apply it to our lives. If you need $100K to live your life, dividing that by .04 means you must have $2.5 million invested before cutting the cord.

Perhaps this suddenly gets real. Seem daunting? It is, at first, and that’s ok. Having a plan will calm the overwhelming task by breaking it down to make it more manageable.

At this point, the lifestyle audit comes in. Applying the 4% rule to each line item of your expenses can prove eye-opening. For every $100 you spend a month, you will need $30,000 in a retirement portfolio spitting off income to pay the bill.

Perhaps you are rethinking cable? Or the ten streaming services we all now have that replaced cable?

The quick math is $100 times 12 gives us $1,200 annually. Divide by .04, and you’ve got the $30K.

The importance of intentional spending

You can likely see why it makes sense, if this appeals to you, to consider every single expense. Imagine looking at your online bank portal and observing each expense as something keeping you at a job you hate.

Chilling, right?

If you aren’t careful, you can find yourself slashing everything to the bone and moving back in with Mom and Dad and being the cheapest person you know. Not a good look.

So, where is the line? How do you know when to stop slashing and what expenses are worthwhile?

Ramit Sethi, another personal finance guy who’s been around the block, has come up with a phrase that I think encapsulates the ability to strike the perfect balance: “Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”

The Latte Factor

One example that sticks out like a sore thumb: “The Latte Factor.” Financial pundits will often make this a hill to die on. If you invest your coffee-habit dollars, the gist is that you can retire that much sooner. People love to fight to the death on this for some reason.

A quick look at rough numbers can frame this. If you spend $7 a day, 365 days a year, on frilly coffees, it adds up. How much? $2,555, in fact. It might seem like a lot or perhaps no big deal.

It’s no big deal with an income in the hundreds of thousands. If you are just starting your career, it might warrant more consideration. Again based on the above 4% rule, you’ll note that to generate enough income for your daily fix, you’ll need $63,875 squirreled away.

If that isn’t enough to make you reconsider, another way to look at this is to consider what that $7 a day could look like invested. Well, given an 8% return over ten years, we are looking at $38,951.04. If I wanted to be dramatic, I could use a 20 year or 30+ year period to make the point. However, it is essential to shrink things down to smaller periods when considering the Financial Independence lifestyle. Sure, if we let the latte compound for 70 years, you’d have enough to get a building named after you at your college of choice.

If all of this is true, why aren’t Financial Advisors all over this?

Things take a little longer than in, say, the Tech space in our industry. Change happens slower here, and there hasn’t been a massive demand for people wanting to retire after only 10-20 years of working for one. Most Advisors will be quick to say to invest (usually but not always) 10-20%, and you’re good to go.

Conversely, this is where the groundswell of FI gets me excited because for some of us, learning that you can accomplish Financial Independence in 10 years opens up new ways of thinking and new possibilities.

When you understand the opportunity cost, you suddenly reexamine things.

“How much do I love cable.”

“Is the fancy car worth it?”

“Why is my hip apartment costing me half my paycheck?”

In the book “The Millionaire Next Door,” the authors point out that the average millionaire drives a Toyota Camry and lives in a $300,000 house. Yes, it was published in ’96 but still. Perhaps not what you think of when you think about millionaires. The Financial Independence community is just taking things to the next level.

So how do I apply this to my life?

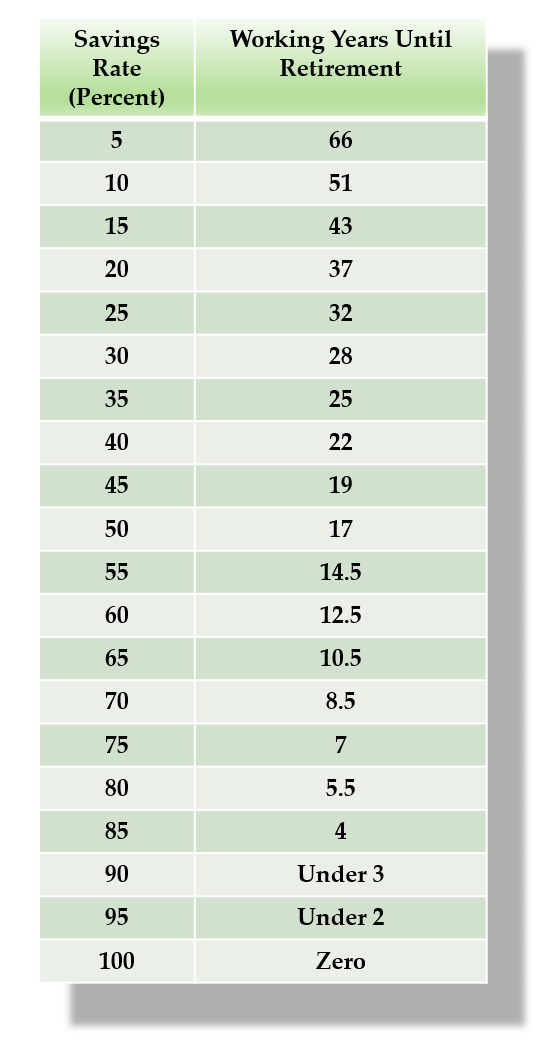

First off, one of the most important numbers to help paint the picture is your savings rate. It’s pretty much what it sounds like, the rate you are saving, expressed as a percentage.

The goal is to increase the gap between what you earn and spend and invest the difference.

As you can see from the graph below, starting with a $0 net worth, assuming a 5% rate of return net of inflation, a 45% savings rate will get you from zero to financially independent in just under twenty years. Shoutout to the legend himself for this graph.

You can see how a few simple tweaks of ye ole’ budget can quickly help make a significant impact on shortening your working career. You can see why financial people always talk about eating out less, driving used cars, etc. Now can you blame them after seeing this?

Armed with this information, you should have a decent idea of when you can pull the plug. From here, most might feel pretty overwhelmed, wondering where to begin or how to increase progress, usually in a way that doesn’t require complete deprivation.

If you are ready for to take the first step in your journey, click here for your free Financial Fortress Blueprint.

You can only slash expenses so much. However, through certain lifehacks and generally a realistic look inward at what brings you joy and what you are spending out of habit, you might be surprised where you can gain back some ground.

That said, for most, the real opportunity is to increase your income without your lifestyle increasing in lockstep. Both are easier said than done.

The three main paths to Financial Independence

The vast majority of people who go down this road will usually have a decent to a high-paying job, which they will use to increase their savings rate by optimizing benefits at work, like the 401k, employee stock purchase plan, HSA, etc. Others will choose real estate investing, and still, others will look to supplement their income with a side hustle or go all-in with entrepreneurship.

I’ll spend a little time on each to consider how each might be laid out and optimized.

Team W2

You’ve been climbing the Corporate ladder since getting out of college. You like what you do, ok, but two weeks of vacation? How will you make all those trips you want with only two weeks off each year? “It’s just not practical,” you tell yourself. You can have time or money but not both, right? Thoughts like this are how it starts for a lot of people. What seemed exciting while fresh out of college dulls over time to pointless meetings that should have been emails, and now you are longing for something more.

Again most people making their way to Financial Independence are right where you are, feeling like you feel. Do not despair. There are great ways to utilize the tools at your disposal. Some you may not be aware of, or at least how they fit in with all of this.

A few examples include:

- Your company’s employee stock purchase plan.

- HSA.

- Potentially even your bonus structure.

Employee Stock Purchase Plan

If you have an employee stock purchase plan, there is often an employee discount to incentivize you to invest. Often this can be a great play to purchase what you can, hold through any waiting period, and then sell for a profit. Rinse and repeat, saving and reinvesting your gains in a diversified portfolio. There is more to it and other strategies, but let’s keep this high-level.

Health Savings Account

Your HSA is a great way to save on healthcare costs. It can also be a significant tax play. The money goes in pre-tax so before Uncle Sam takes his cut. From there, the money, or a portion of it, usually once you have at least $1,000, can be invested!

Often people don’t realize this. It can be a powerful tool to have. The ideal scenario is that this pre-tax money has the potential to grow tax-deferred for years to come. Qualified medical expenses are covered tax-free. If that wasn’t good enough, it gets better. If you can pay out of pocket for these medical expenses and keep good records, you can reimburse yourself with tax-free dollars. This strategy allows those dollars continued growth potential. Imagine putting in the $7,000 max amount every year, paying out of pocket, and investing it for 30 years. You will have racked up some expenses during that time that can be reimbursed tax-free and be a tool for accessing retirement dollars pre-59.5.

The Annual Bonus

Your annual bonus has some tricks too. Let’s say you make $100K with a 10% yearly bonus ($110K all in). This hack focuses on cash flow management. Often bonus income gets hit with 40% withholding, meaning your $10k bonus receives a $4k bite taken out, earmarked for taxes. You’ll likely get a lot back next tax season. This behavior usually falls in line with most people’s habits: Work hard, get bonus, spend bonus.

That’s not how we roll.

If your goal is to max out your 401k for the year, one optimal approach is: Lower your 401k contribution only to get the match. Do the math to see what else you need to hit the limit, then put that much of your bonus into the 401k. This way, you’ll still likely get all of the match and increase your monthly income by dropping your contribution to the minimum for the match. This hack also sidesteps the 40% withholding enabling you to max out your 401k in the most efficient way possible, get a substantial monthly raise, and still likely have some bonus leftover.

These are just a few high-level tips to make the most of your 9-5. If you analyze your situation, you can find many ways to squeeze the most out of your income and slash your expenses. Doing so can allow many to retire in 10 years or even sooner.

Real Estate as a path to wealth

Many will know that real estate has been an asset class of choice for many wealthy people. One can dabble in real estate to achieve FI or go all-in to be a full-time real estate investor eventually.

The Financial Independence community loves the “house hack.” A house hack in this context is when someone buys a house, typically a duplex, triplex, or quadruplex, to live in 1 unit and rent out the rest. The goal is to live for free, though you can come out ahead in many cases. If you have three other units under one roof, chances are you stand to make some money over and above your mortgage, taxes, and insurance. Eliminating your biggest expense is one of the best ways to free up money to invest.

House hacking is perhaps not the most appealing way to do things when you are a little older, married, with a few kids. If that’s the case, have no fear, there are other alternatives to get into real estate investing. The easiest is to use REITs or Real Estate Investment Trusts as a way to gain exposure to real estate investing but without needing to fix a toilet at 3 am or save up a sizeable down payment. It is very similar to other paper assets, and you can often start with a small amount of money and add to it monthly.

Consider short-term rentals

Airbnb has opened many doors for would-be real estate investors. It can be an excellent way for people to dip their toes into the waters of real estate investing. Often people start by renting a single bedroom in their apartment or home. Some will convert a basement or guest house to a full-time Airbnb to offset or eliminate their mortgage payment. Still, others will get multiple units, scaling up to hit Financial Independence in record time.

With Airbnb or even long-term rentals, you can scale your approach. You can implement systems and often get to your FI goals faster than with more traditional investments. The challenge is they’re less passive than putting money in an index fund. Over time you can certainly scale your approach. It is worth noting that it does take some serious work on the front side to make it work.

The budding entrepreneur

Entrepreneurship certainly holds the most freedom and monetary upside of all of these. Before sending the hate mail, I would undoubtedly qualify a “Real Estate Investor” as an entrepreneur. There are infinite possibilities in this category which is a huge blessing but can make it challenging to narrow down a focus. Your side hustle can turn into a full-time gig, and many do. What starts as a freelance one-off can blossom into a huge business.

For those seeking Financial Independence, it’s essential to clarify what you want. Most won’t want to go out on their own to accidentally create another full-time job for themselves with more risk and possibly less reward.

There is absolutely nothing wrong with going off on your own and discarding the idea of FI in the “traditional” sense because now you have found your life’s calling. It’s just important to be aware of how things can change over time and begin with the end in mind. Most seeking this approach will consider building systems and often outsourced partners and tools to help leverage their ability to scale and continue buying time back.

After taking the leap, many lamented waking up to realize they had created a new hamster wheel that requires 12 hour days to stay spinning. Start with the end in mind and be intentional with what you want.

Entrepreneurship can incorporate, as we said, freelance opportunities gig economy opportunities. However, it’s worth keeping an eye on your per-hour income to make the most of your time with the latter. Entrepreneurship can entail franchises, so you don’t have to start from scratch or more passive and even “boring businesses,” like vending, laundromats, or car washes. Anything is possible here.

Taxes and Financial Independence

Taxes are a big deal in the Financial Independence community. Given the shorter runway to financial Independence, you must keep an ever-watchful eye on taxes. If you have $5 million in an IRA, but you’re 30 years old, you likely have a tax problem. However, this community is very resourceful in finding loopholes and workarounds to achieve their early retirement goals. Like perhaps nothing else we discuss, taxes require beginning with the end in mind.

Everyone wants tax-free money. However, the real question is:

“how do you get tax-free money in the most optimal way for your family’s plan?”

The earlier you become financially independent, the more you benefit from contributions to your tax-deferred accounts.

You received a tax deduction when contributing to your tax-deferred accounts during your working years.

Once you become financially independent, you can begin converting those pre-tax retirement accounts to a Roth IRA.

Hopefully, this creates a level of tax arbitrage. For example, you might get a tax deduction in the 35% tax bracket and then convert it to fill up your 12% tax bracket.

If this strategy intrigues you, you’ll need dry powder in non-qualified investment accounts to pay the tax upon your conversion.

This strategy can be incredibly potent for younger professionals who plan on selling a business much earlier than 65-years-old or high earners who can maintain long periods of superior savings rates.

Late start? Not to worry

You might be reading this thinking, “ok, this sounds great, too bad I didn’t hear about this at 18.” You are not alone. Thankfully these concepts apply to those with a few more decades under their belt. You can utilize many strategies and get your savings rate high enough to step away from the 9-5 still perhaps decades sooner than you might otherwise. The later you wait, though, the more your savings rate comes into play. Again, though, as we’ve mentioned earlier, with the right job, savings rate, and spending habits, you could start from 0 and still hang it up in 10 years.

Who benefits the most from starting sooner?

You may also be reading this thinking, “it may be too late for me to perhaps retire at 30, but this would be life-changing information for your kids.” You’d be right on the latter.

There are ways to get your little ones off to a great start, and some tips might not be what you’d expect.

The most obvious is the 529 account to save for college. While that’s great and a noble desire to pay for your kids’ schooling, the cost of college continues to rise and outpace wages. You might pay for a pleasant college experience, only to still have junior shacking up at your house for years to come. More and more employers utilize specialty certificates or other experience than just relying on a 4-year degree.

You might consider a combination strategy of using a 529 alongside other tools like a UTMA account. A UTMA (Uniform Transfer to Minors) is just a fancy government title that means an investment account for a minor where the parents are the owner of the account, so your kids can’t run off with the cash, at least until age 18, or 21 in some states. You’d invest this like any other account. Imagine giving your kid a downpayment for their first investment property or starting their early retirement journey that, on its own, could compound over decades to potentially retire your kids, with only the need to wait 60 or so years.

Another niche strategy is to employ your children in your business. Employing them allows the use of some or potentially all of the income to fund a Roth IRA. The beauty here is having the potential for tax-free income that compounds for decades.

A note on investing strategy

Many in the Financial Independence community are avid fans of Index funds, and it’s easy to see why. An S&P 500 fund tracks the S&P 500 to mirror the returns without all the fees actively managed counterparts incur.

Often these funds are so bargain-priced with an expense ratio of .03% or somewhere in that range. Compared to an actively managed mutual fund, the fee is often in the neighborhood of 95% less in cost.

But what’s 1%, you ask? Compounded for decades, it can add up to be a lot. Also, the performance of actively managed funds overall is a mixed bag. Chasing the new hot fund, let alone individual securities is a fool’s errand. Sure, you might have had some good returns and gotten lucky, but it is difficult to beat the index year in and year out over 20 years. Save your time and stress and consider the passive investing approach.

Adopting a passive approach

Fortunately, most 401ks have low-cost passive options that you can set to systematically invest in the background with little effort on your part. When investing in this manner, share accumulation is the name of the game. Investing is often like soap. The more you touch it, the less you have. I’m oversimplifying here, but investing early and often is the recipe for potential long-term wins.

Thankfully this approach accounts for concerns around market-timing. Everyone wants to time the market, but unfortunately, even the pros are not great. This is where dollar-cost averaging shines. Dollar-cost averaging takes a systematic approach by breaking down the amount you have to invest and making periodic investments over a given time horizon. In English, if you want to invest $12,000, invest $1,000 on the same date each month.

As the market goes up and down over the year, you stay committed without overthinking it or trying to time the market. Automation makes it easy to avoid overthinking it or chickening out. With the fluctuations inherent in the market, you get a discount some months or pay a premium in some months, but the average price you pay can potentially be lower than the average share price of the fund. Doing this for years is a great strategy to build wealth. Again the name of the game is to collect shares, so as they go up, your wealth increases.

Where the FIRE community misses

All this sounds great. Right? Slash your expenses to the bone, move back in with your parents and say no to all fun until you hit your FI number. Ok, just kidding, though unfortunately, that is what some outsiders think of this “movement.”

I am poking fun, though there are people that can take it to an extreme. Some people sacrifice so much to hit their goal, get there, and don’t know what to do with their lives. It might sound easy to think, “you will figure it out when you get there,” or “how sad, they’re financially independent, boo hoo,” but some of these people can go for long periods feeling like a fish out of water and regretting the decision to pull the plug.

Thankfully many can find employment if needed. However, the general wisdom is to drill down on your “why” for doing this in the first place, and have something to “retire to.”

Protecting your down-side

Also, many of these people are hardcore DIYers. Nothing wrong with that by any means, though there are challenges to overcome. One is the protection side of things. When saving money is the name of the game, it’s easy to be underinsured or uninsured. Not a wise move, certainly long-term. Even not having adequate liability insurance can come back to bite you. What if someone slips on your property, breaks a leg, and decides to lawyer up?

Life insurance is one area where the Financial Independence community could stand to gain new insight. Since many make it into the world of FIRE after desiring “more” from the completion of the Dave Ramsey baby steps, they have a skewed view of life insurance. Term insurance is acceptable and has its place. Are you aware that a term insurance death benefit pays out around 1% of the time? You rightfully hope to never get in an accident with car insurance, but everybody dies.

You don’t know what you don’t know, until you know

Permanent insurance can be an appropriate consideration for people looking to retire early. A boring Whole Life policy, often derided for not having the stock market returns, shouldn’t be compared to stocks in the first place. Life Insurance companies invest in bonds. So comparing the returns to the stock market isn’t comparing apples to apples.

Having a sliver of your bond portfolio in Whole Life insurance can be a prudent play. Again sliver is the keyword here. Whole Life insurance can be complicated, but it can be the Swiss Army knife of financial planning and has lucrative tax advantages. I want to give as much money to my family as possible. Life Insurance is one of the most efficient ways to do that income-tax-free. As I mentioned, the cash account typically has bond-like returns, which aren’t stock returns, but they are certainly better than your savings account. Especially in a low-interest-rate environment. Also, they’re guaranteed, so when the stock and bond market is down (like 2008), you have somewhere to get cash. It gets better. You can take a loan against your cash value instead of withdrawing the money, risking lowering the death benefit, or paying taxes, for that matter.

Call in the professionals

Enough about life insurance. It’s important to consider other protection items like Disability insurance, getting a will, power of attorney, etc. Sometimes, people can miss those things when you are going it alone. Not much is worse than working your tail off to scrimp and save every penny, only to die and have your life’s work locked up in probate or go to the state.

The FIRE movement is one of the best things to happen to personal finance and the world, frankly. Seeing people take control of their finances and choose to live a life of intentionality is genuinely inspiring.

As you can see, things can get really complicated, and there are many moving parts. If you are on this journey (or considering it), get the help of a professional. Even if it’s just to ensure you are fully optimized. At worst, a few hundred bucks will go a long way to ensuring decades of success. Click the link to book a complimentary call with our team to ensure you aren’t missing any of the countless opportunities to optimize your plan.