Saving for your children’s college is undoubtedly a noble goal. Many have benefited from Mom and Dad working hard to send them to college. Often without the need to take on any debt without paying them back, chipping in, or getting a part-time job. All good things.

Now that you have kids, you want to pay it forward. You want to give your children the college experience you had. Again a worthy goal. The real rub is that things were different back then.

Depending on when you went to college, Mom and Dad may have or have had the prospect of a pension. Having the retirement box checked goes a long way to making college affordable.

The other huge change is the cost of a four-year education. The price has more than doubled despite counting for inflation. Add to that the lack of rising wages, and parents today are in a real pickle.

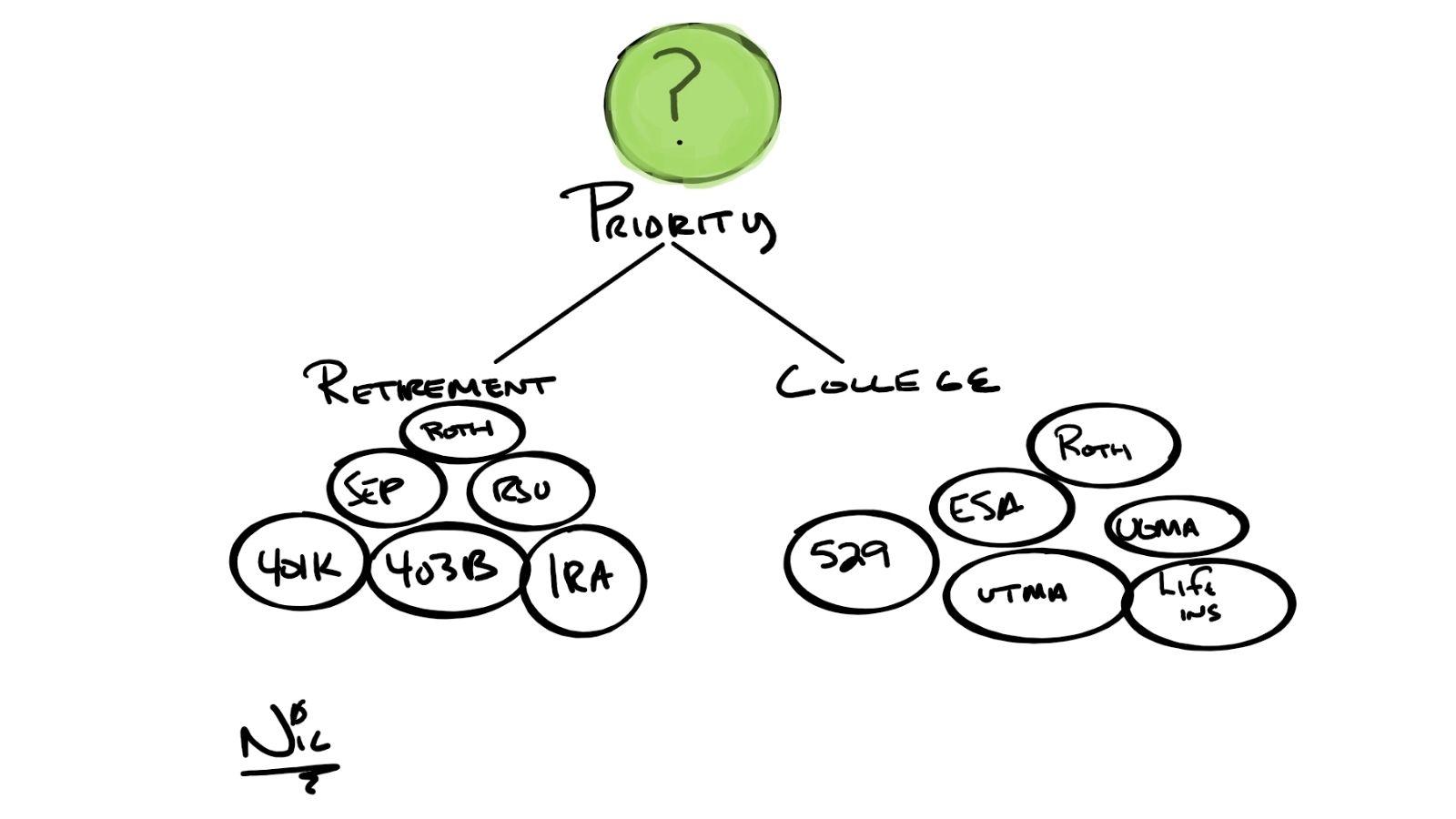

“How do I prioritize saving for my retirement versus saving for my children’s college education?”

The most fitting analogy is the message, “in the event of an emergency, please put on your oxygen mask before assisting others.”

You very well might love the idea of your child graduating debt-free from college more than the idea of becoming financially independent at age 62.

I am using the phrase “financially independent” instead of retirement intentionally. I define “financially independent” as the financial ability to stop working at your choice. Your plan no longer requires your ongoing employment income.

If you do not have the cash flow to fund both goals simultaneously, then you must choose to support “financial independence.”

Why? There is a multitude of ways to pay for college:

- Part-time Job(s)

- Become an RA

- Student Loans

- Military service

Unfortunately, you cannot borrow your way into becoming “financially independent.”

While the above statement may be a tough pill to swallow, and you might even feel selfish, it is a more prudent path. You don’t have to sacrifice your retirement for college and vice versa. Some sacrifices are necessary. You can’t tell me that college is your number one priority when you are saving $50 a month for your kid’s college while having an $800 a month car payment. Aside from things like that, it would be best if you put retirement planning first, but college planning can be a close second.

IMPORTANT INFORMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.