In our practice, we often refer to the fact that there are 3 barbarians coming to take your money. The most powerful of which is often your own behavior.

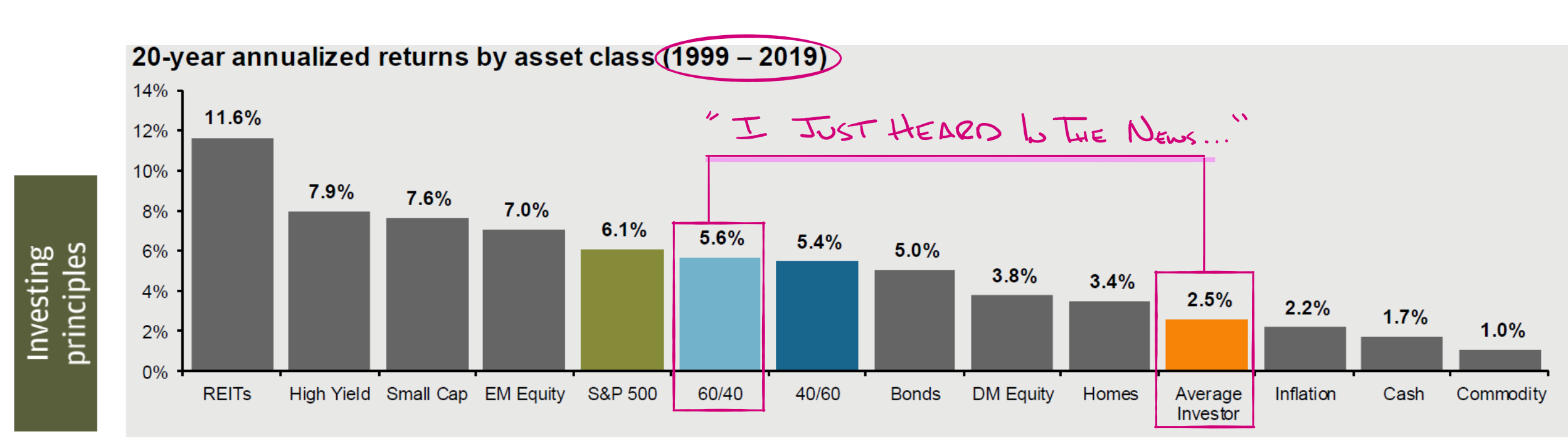

In my experience, it generally begins with the client or prospect uttering the phrase, “I just heard in the news <I need to put all my money in stocks, I need to sell all my stocks, it is time to buy gold,>…”

The problem with managing your own money is that it is nearly impossible to separate the emotions of fear and greed from making rationale investment decisions.

????Why work with a financial planner? Hopefully, they are a voice of reason before making an extreme decision that is not in line with pursuing your goals.

Only make changes to your portfolio IF something has changed in your plan.

⭐⭐⭐Remember: Your goals determine your plan. Your plan determines your portfolio.⭐⭐⭐

NOTE: The Average Investor is defined by DALBAR. DALBAR’S year Quantitative Analysis of Investor Behavior (QAIB) study examines real investor returns from equity, fixed income and money market mutual funds from January 1999 through December 2019. The study was originally conducted by DALBAR, Inc. in 1994 and was the first to investigate how mutual fund investors’ behavior affects the returns they actually earn.