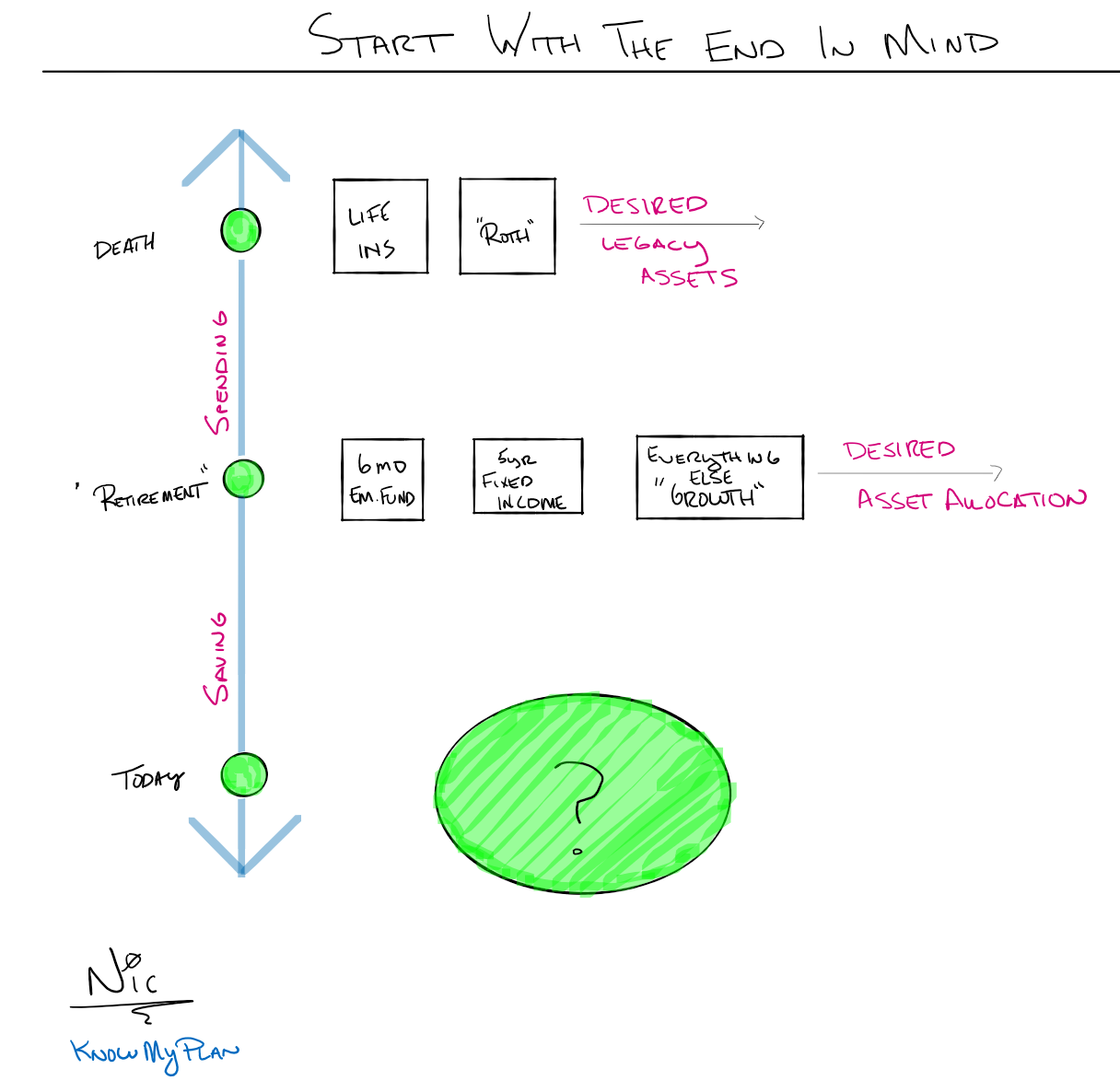

When planning for retirement, it is most important to start with the end in mind. The end of this life is death. At death, the most efficient assets to own currently, are life insurance and Roth accounts.

Efficiency matters

Why Roth accounts and life insurance?

Firstly, we must think about asset location.

What is asset location?

Simply stated, asset location is where you keep your money invested. For instance, you have tax-advantaged, taxable and tax free options.

Great news! Life insurance and Roth accounts fall into the tax free bucket.

What does this mean?

Presently, life insurance death benefits and Roth account balances pass free of any state or federal taxes to your beneficiaries. In short, asset allocation and asset location are vital to a strong plan. For my clients, for example, I advise:

- 6 months of expenses set aside in cash, for emergencies.

- 5 years’ worth of income in fixed income.

- All remaining assets of the portfolio invested for growth potential.

What about today? How do you get from where you are, to where you want to go?

Start at the finish line

In time, the goal of a financial plan is to put you on a path from wherever you are today, to the most optimized end goal for your unique situation. If you aim for nothing, you will hit it every time. Things change so no one plan is perfect. A long-term relationship with a financial professional ensures a plan that evolves, with you and your goals. In conclusion, it is important to start with the end in mind and from there, work back to what you should be doing each week, month, or year to stay on the right path.