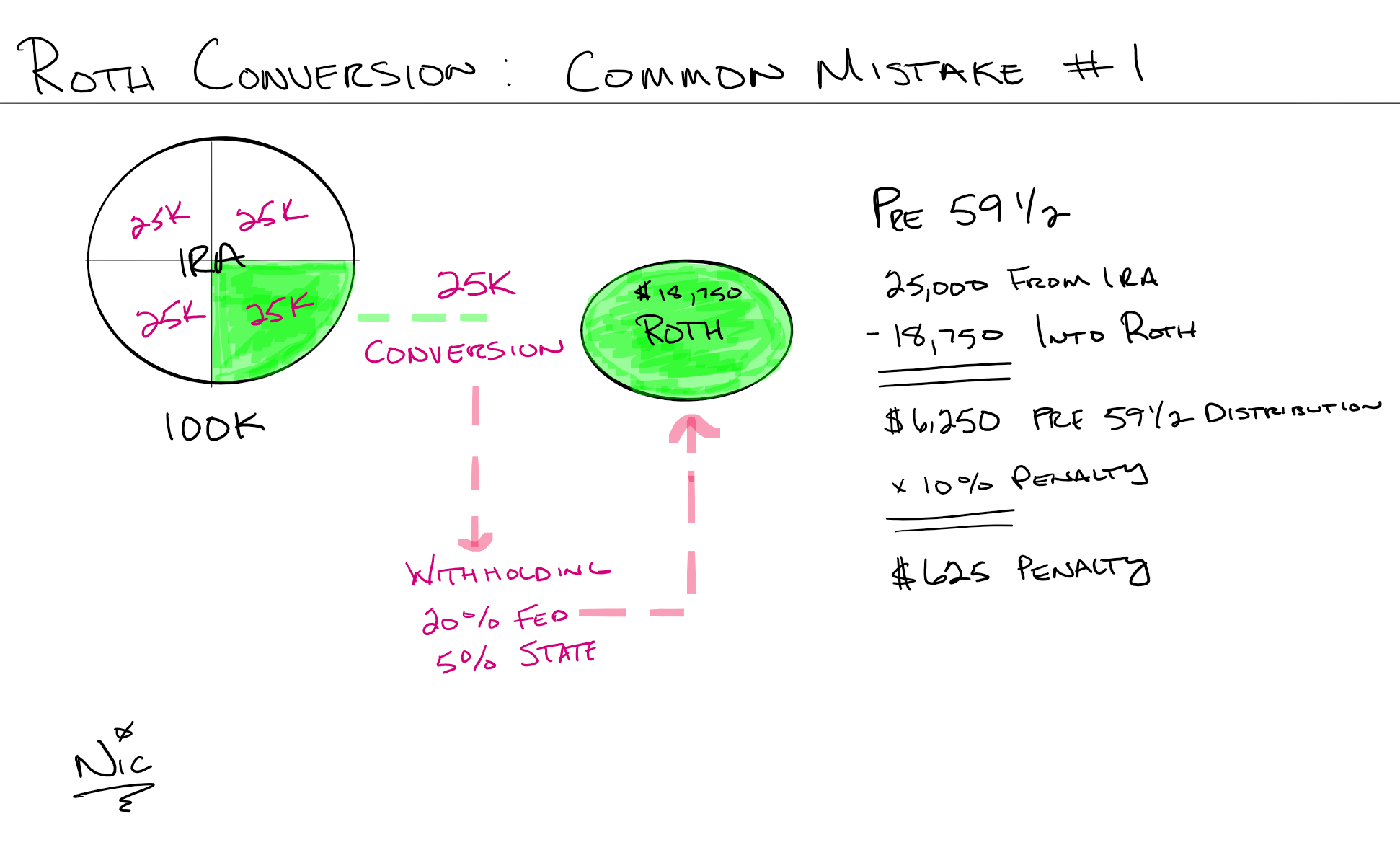

If you are under 59 ½, do NOT withhold when doing a Roth conversion.

Why? If the amount converted from the IRA to the Roth IRA does not match, the difference is considered a pre-59 ½ distribution that is subject to a 10% penalty.

I have seen too many people inadvertently trigger this 10% penalty.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion.