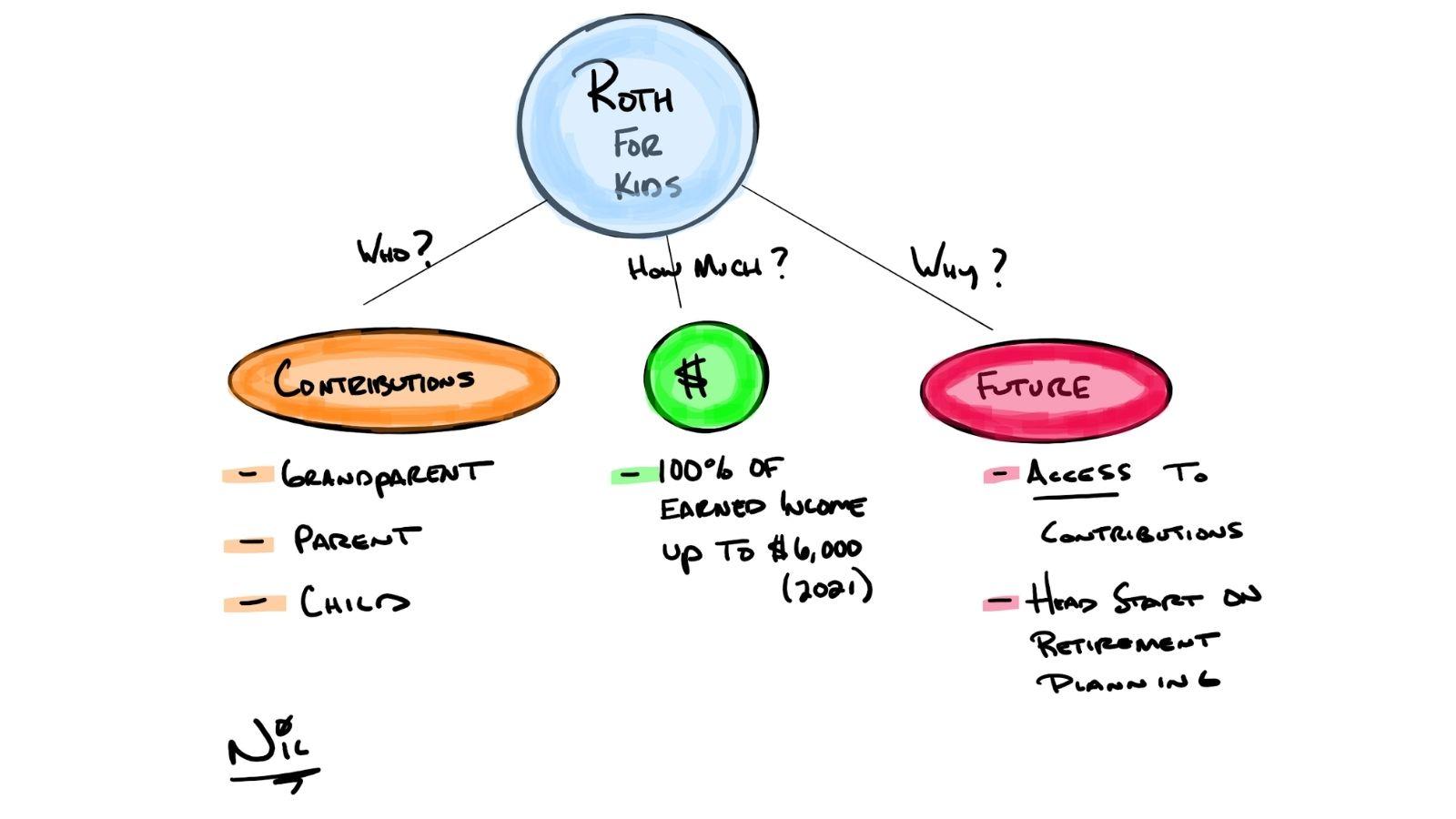

Most people do not realize that your children can have Roth IRAs as minors.

- A custodian (parent, grandparent, etc.) will be appointed until the children reach the age of majority (usually 18 or 21).

- 100% of earned income can be contributed to the Roth IRA up to $6,000 (2021).

For example, if your child makes $2,000, they can contribute $2,000.

- The Roth IRA offers a huge head start in your children becoming financially independent.

NOTE: You always have penalty-free access to the contributions (not the earnings).

IMPORTANT INFORMATION

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax.

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

LPL Tracking #1-05124549