Financial Planning is so much more than just investing. People often think that a Financial Advisor exists mostly to generate a rate of return. Sure rates of return are important but financial planning is much more in-depth than people realize.

Protection isn’t sexy

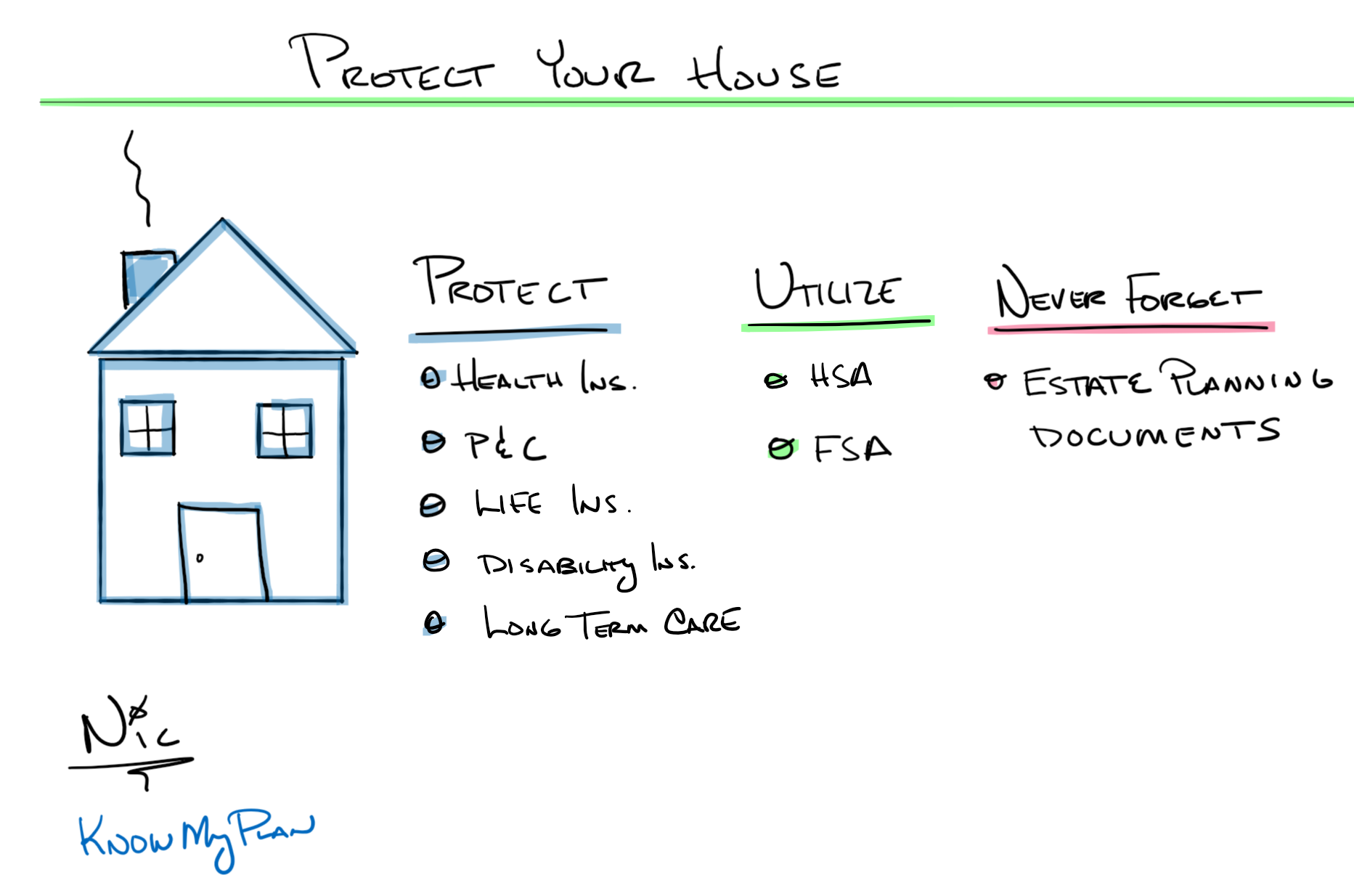

There are fundamental “protections” that should occur within our financial plan. Before we even start thinking about long-term savings and investments. The conversation around protection isn’t always easy. You cannot talk about protection without talking about loss. Things happen in life that are not always fun to think or talk about. However, when ‘life happens’ thinking about money should be one less thing to worry about if you are planning accordingly.

For example, getting cancer without health insurance can zap your great investment portfolio overnight. No one wants to pay for health insurance, because it certainly isn’t cheap. We all know it’s still way less expensive than having an injury, accident, or disease that bankrupts you along the way.

How to protect your downside

Insurance is a transfer of risk. Our goal is to transfer the risk of the catastrophic from our own portfolios to an insurance company. We want to spread the risk out amongst many people trying to do the same thing. Insurance is fantastic for big harry scary catastrophic events. On the other hand, you can probably skip the extended warranty on your new toaster. Extended warranties are basically insurance on a small scale. Most of the time you are better off by self-insuring via your own long-term savings.

Consider insuring things like your health, your home, and your car. Don’t forget to insure your largest asset. It may not be what you think. Your ability to generate income is your greatest asset! Your income is what funds everything else. If someone is depending on you financially, life insurance should be at the top of your list!