As I write this note, the S&P 500 index is down more than 23% year-to-date. In addition, the bond market is down around 14% year-to-date. There has been no place to hide. Diversification in 2022 has meant very little. Nobody enjoys the pains that come with entering a recession: potential job losses, plummeting net worths, and higher mortgage rates. We certainly are not in the short-term prediction business.

Recession Research

https://awealthofcommonsense.com/2022/06/timing-a-recession-vs-timing-the-stock-market/

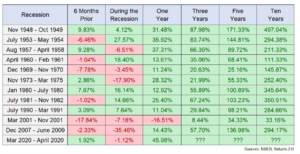

In this paragraph, this chart as it describes what has happened in the S&P 500 during the previous twelve recessions.

We have no idea how long this recession will last or how deep the ultimate drop in the stock market.

However, I feel confident that five to ten years after this recession is all over that we will be glad that we maintained our core belief in the benefits of being long-term goal-driven equity investors.

[I implore you to take a moment and look at the Ten Years return column.]

Portfolio Worry

You don’t have to worry about how your portfolio is positioned versus the current economic backdrop. Remember, that is our job.

We remain patient and disciplined in our long-term investment approach.

If anything in your situation has changed, please reach out to us so we can plan accordingly.

We are here, and we love hearing from you.

Invest and plan confidently,

— Nic & Jeff

We are a full-service financial advisory company that allows you to make a one-page plan for your money and prepare for your future. Learn more about what we do and how we can help you here.

___________________