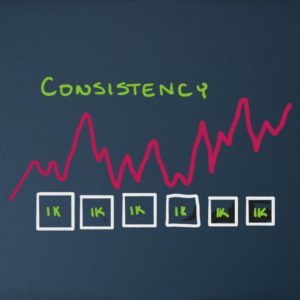

As I write this note, the S&P 500 is currently at 3,998 (let us round up and call it 4,000). The S&P closed the year above 1,000 for the first time in 1998 at 1,229. The stock market consistently has had its ups and downs, but at Know My Plan we understand how to survive that market chaos and make smart investments.

A Trip Down Memory Lane

Let me get nostalgic for a moment and go down memory lane of what 1998 looked like.

Iconic movies were made like Titanic, Armageddon, and Saving Private Ryan. The most popular songs were “I Don’t Want To Miss A Thing” by Aerosmith and “My Heart Will Go On” by Celine Dion.

Google was founded.

The most popular TV shows were Friends, ER, and Seinfeld.

This seems like 25 minutes ago and not 25 years.

The past 25 years have not been an easy time to invest.

There were three times when the S&P 500 dropped more than 30% between 1998 and today:

1/ The Dot-com bubble: the S&P 500 fell 49.1%.

2/ The Financial Crisis: the S&P 500 fell 56.8%.

3/ The COVID-19 pandemic: the S&P 500 fell 33.9%.

The Investment Facts

If you had invested $1,000 every month in the S&P 500 on the first trading day of every month from January 1998 through December 2022 (end of 2022), your total investment would have been $306,000 (12 months x 25 years x $1,000).

Assuming you reinvested all dividends and experienced the average annualized return of the S&P 500 over that period of approximately 6.3%, your investment would have grown to approximately $919,000 at the end of 2022.

The Takeaway

Amidst the chaos of it all, the patient, disciplined, goal-focused, long-term investors saw their wealth compound by ownership in companies.

We believe that few things are more efficient at creating a “nest egg” than ownership of companies to create a constantly increasing income throughout a three-decade plus retirement.

Let’s stay the course and continue to focus on our long-term financial dreams.

If any of your friends or family have financial or investment questions, we are happy to be a sounding board for them. If they are important to you, they are important to us.

–Nic & Jeff

We are a full-service financial advisory company that allows you to make a one-page plan for your money and prepare for your future. Learn more about what we do and how we can help you here.

__________________________

It’s important to note that the S&P 500 is a broad index of 500 large-cap stocks, and not all investments within the index will perform the same. Also, past performance is not a guarantee of future returns.

Dollar-Cost Averaging does not guarantee against loss.

Past performance is not indicative of future returns.