I love insurance! I believe in protection against the worst-case scenarios first.

CASE STUDY:

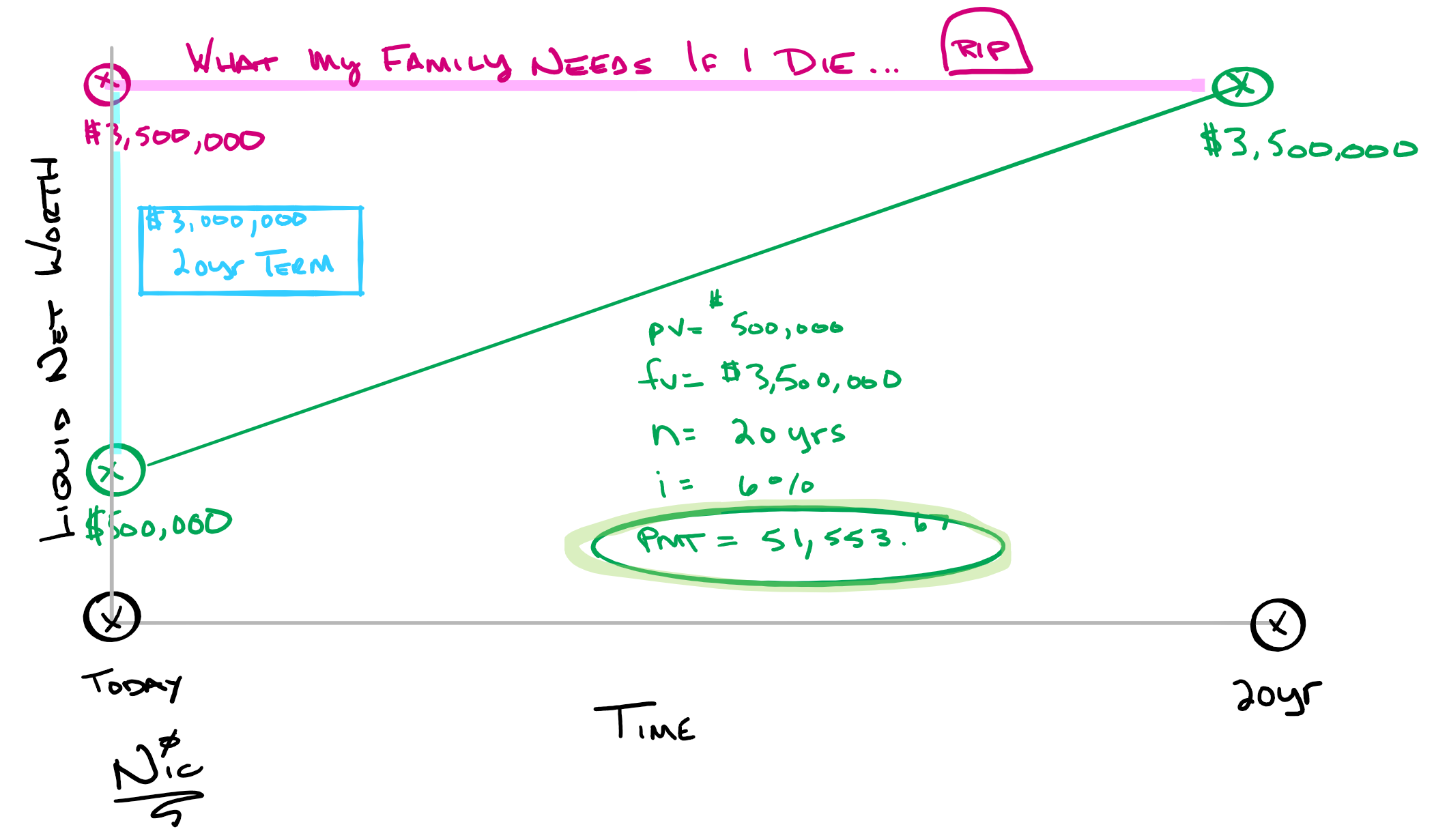

???? Analysis shows that my family needs $3.5m today if I died

???? Currently, my liquid net worth is $500k

???? I solve for this gap by purchasing a $3m 20-year term insurance policy

????What would I need to do to have a $3.5m net worth in 20 years?

Assuming a …

4% rate of return, I would need to invest $80,745/year

6% rate of return, I would need to invest $51,554/year

8% rate of return, I would need to invest $25,557/year

10% rate of return, I would need to invest $2,379/year

???? Invest wisely

???? Pick the right tool for the right job