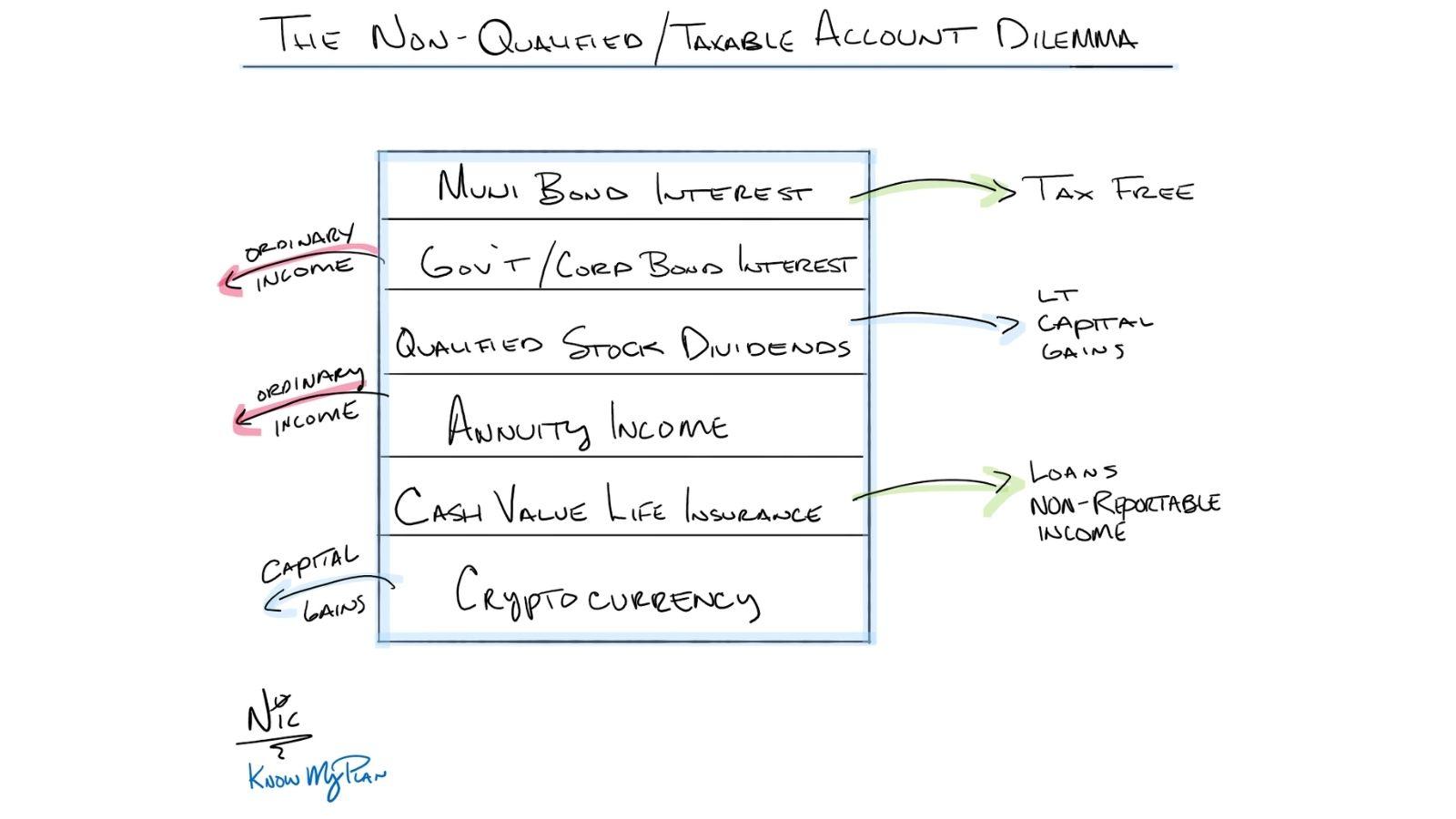

High earners must be especially careful with asset location. After all, you can only contribute so much to your 401k/403b plans. After maxing out employer-sponsored plans and retirement accounts, you are forced into looking at non-qualified (taxable) account options.

Pay close attention to how certain assets are taxed.

A couple of examples:

Municipal bond interest is federally tax-free, but the current rates for most investment-grade municipal bonds are low.

Corporate bond interest is taxed at ordinary income. For most high earners, it just does not make sense to own corporate bonds in taxable accounts.

IMPORTANT INFORMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.