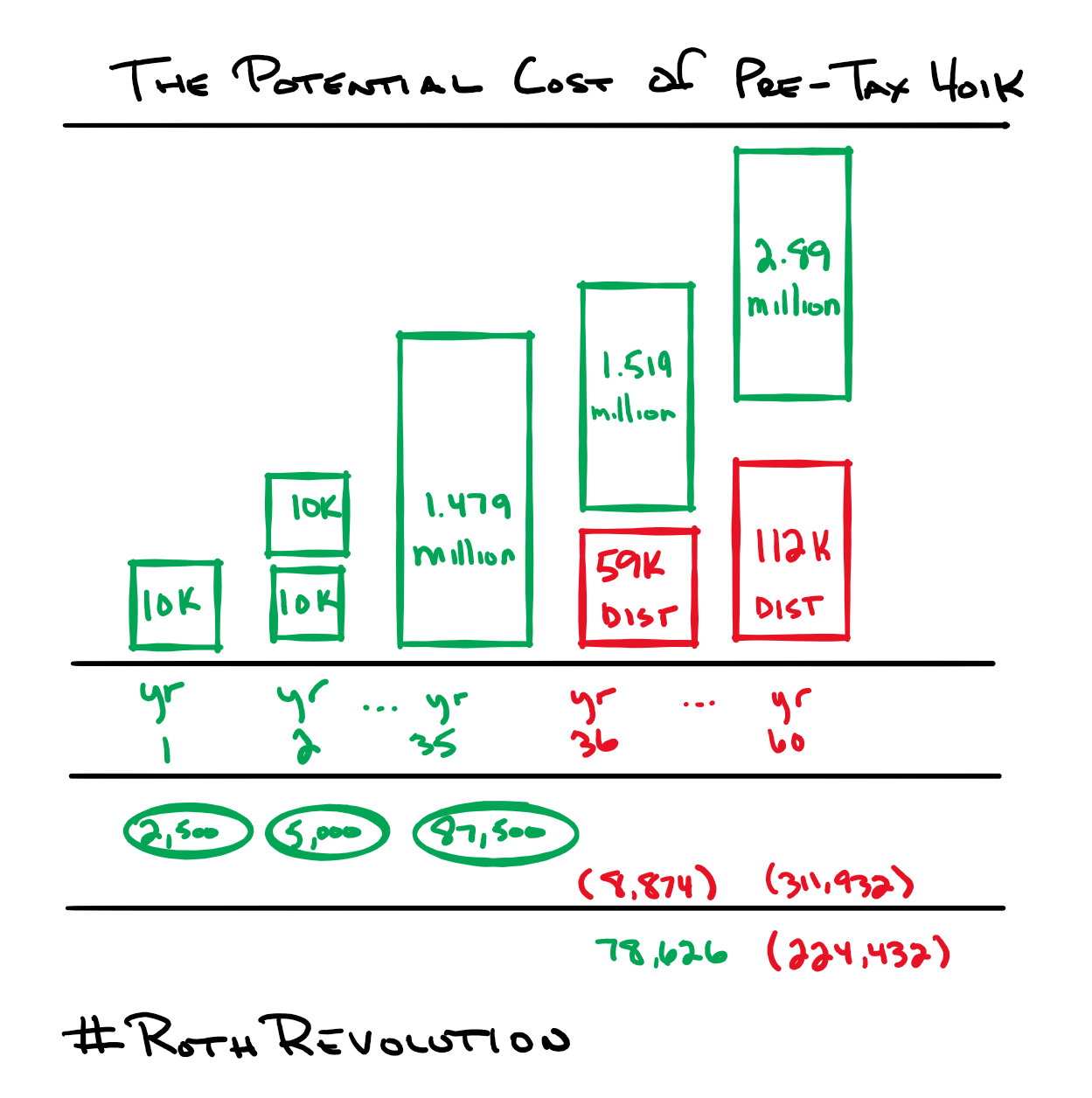

Consider this example:

???? 30yr old – contributes $10,000/year to a pre-tax 401k for 35 years – the participant earns 7% per year – is in the 25% tax bracket

???? Receives a $2,500 tax break annually

???? Retires at 65 and takes a 4% distribution of the previous year end account balance – 15% tax bracket – continues to earn 7% per year for 25 years.

The Results:

✔ $87,500 of tax breaks while working (35 years x $2,500/year)

✔ During retirement, pays taxes of $311,932 ($2,079,052 x 15% tax rate) on distributions of $2,079,552.

✔ At death, the account balance is $2,893,230. These funds will be taxable to beneficiaries.

✔ The total taxes paid over the 60 year period is $224,432

????What would have happened if the participant contributed to a Roth 401k instead?

⭐ $87,500 of total taxes paid (35 years x $2,500).

⭐ $2,079,552 of tax free distributions in retirement

⭐ At death, the account balance is $2,893,230 will go tax free to beneficiaries.

Join the Roth revolution!

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing. Tax brackets may change.

No strategy assures success or protects against loss. Investing involves risk including loss of principal.

For a Roth 401(k), withdrawals of contributions and earnings are not taxed provided it’s a qualified distribution – the account is held for at least 5 years and made:

•On account of disability,

•On or after death, or

•On or after attainment of age 59½.

For a pre-tax 401(k), withdrawals of contributions and earnings are subject to Federal and most State income taxes.