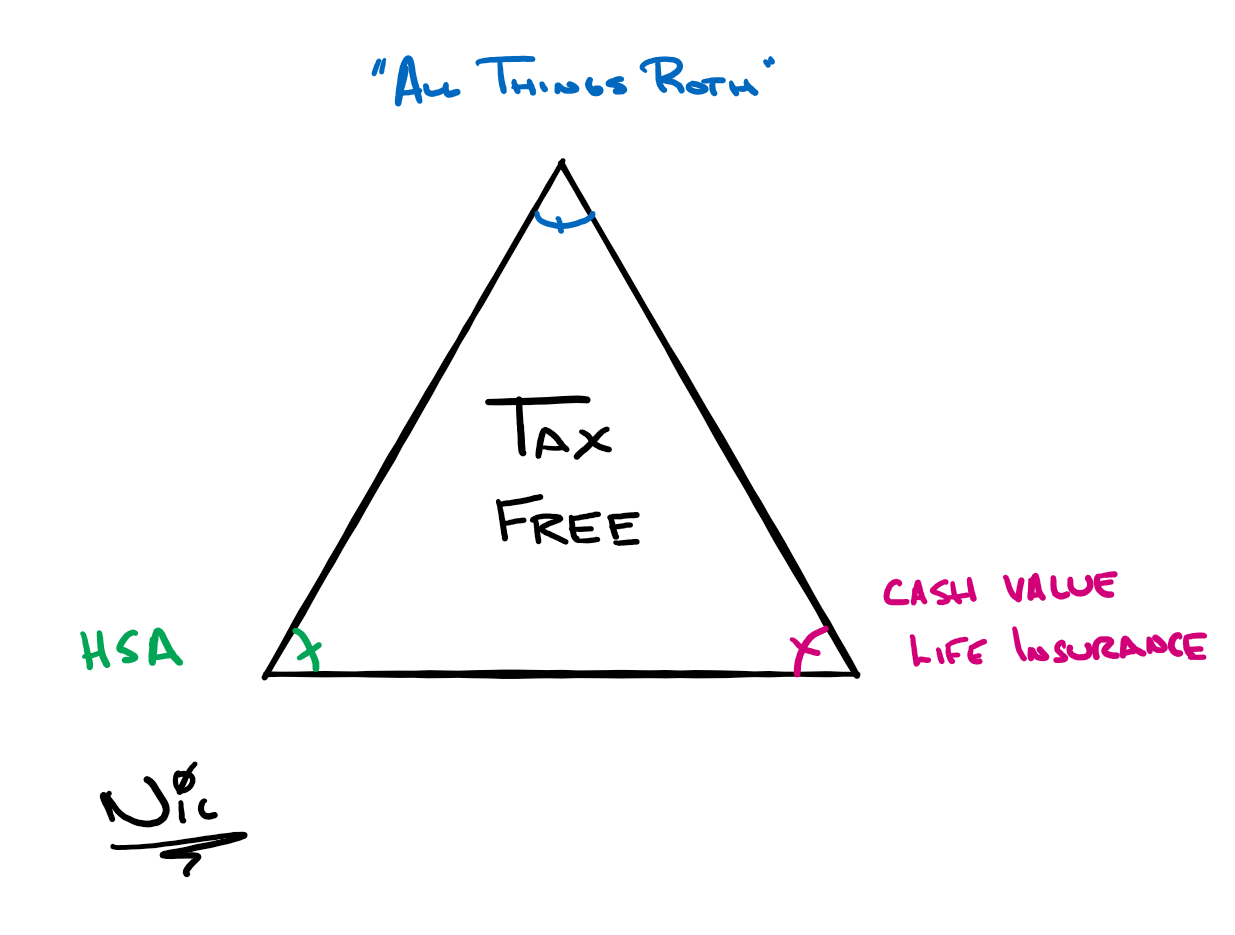

I want to share with you three ways to create potentially tax-free income. In full disclosure, they’re not the only options, but I feel these three options are readily easily to facilitate for the masses:

- “All Things Roth” – You’ve already paid taxes on your contributions, funds grow tax-deferred, and if you follow the rules, distributions come out tax-free.

- Nic’s Note: Your contributions in a Roth IRA can be accessed at any time without penalty.

- Cash Value Life Insurance – You can technically “borrow” your cash value; therefore it’s non-reported income for tax purposes.

- Nic’s Note: In most cases, you need to be able to not touch your contributions for 10-15 years before accessing funds.

- Health Savings Account – The most efficient of the tax-free options discussed. Your contributions are pre-tax, earnings are tax-deferred, and qualified medical expense withdrawals are tax-free. In essence, these funds can potentially NEVER be taxed!

IMPORTANT INFORMATION

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

Roth withdrawals of earnings prior to age 591/2 or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax.