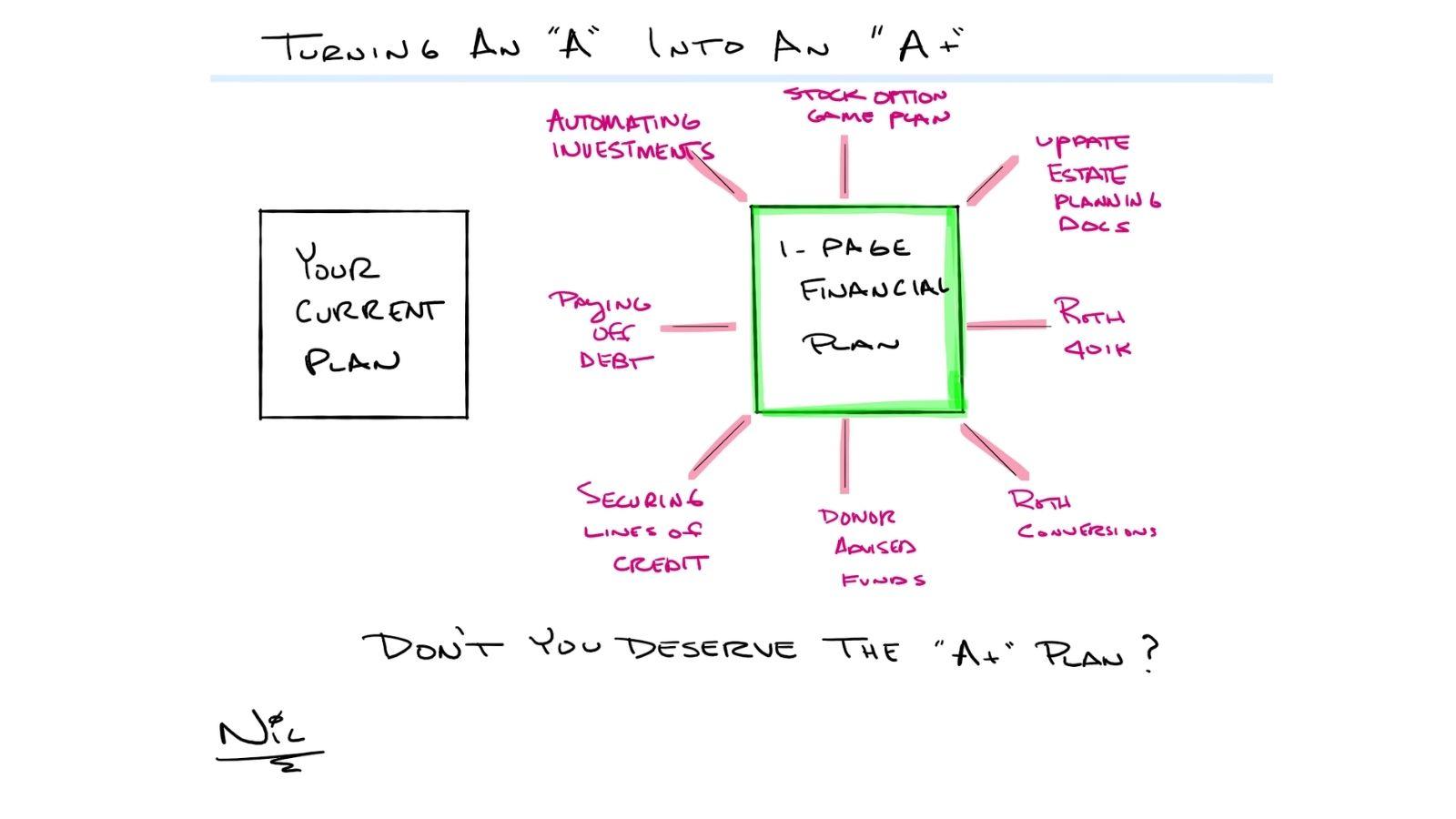

Many of the prospects that we meet with have a good start on their financial plan. In many cases, their current plan is an “A.”

As a financial planner, I am trying to find the gaps from taking the plan from an “A” to an “A+.”

Whenever the “A+” plan is put into place, we continue to evaluate and monitor it.

Believe it or not, every single financial plan is wrong the second it is created. There are just too many variables at play.

The plan must be monitored on a regular basis to make sure it maintains “A+” status:

Why? What is best today might not be the best tomorrow:

- Tax Law Change

- Retirement Plan Contribution Amount Changes

- Most importantly, your personal situation could change.

IMPORTANT DISCLOSURES

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

All investing involves risk including loss of principal. No strategy assures success or protects against loss.

LPL Tracking #1-05137544