I believe it is important to have mechanisms in place to access to money. A popular mechanism to access money is a home equity line of credit. Just because you have it, doesn’t mean that you have to use it. It can sit with a zero balance until a major purchase or emergency arises.

The best time to get one of these HELOC’s in place is when you do not need it. Do not wait until you lose your job or retire. If you do, it will be much harder for a bank to approve you.

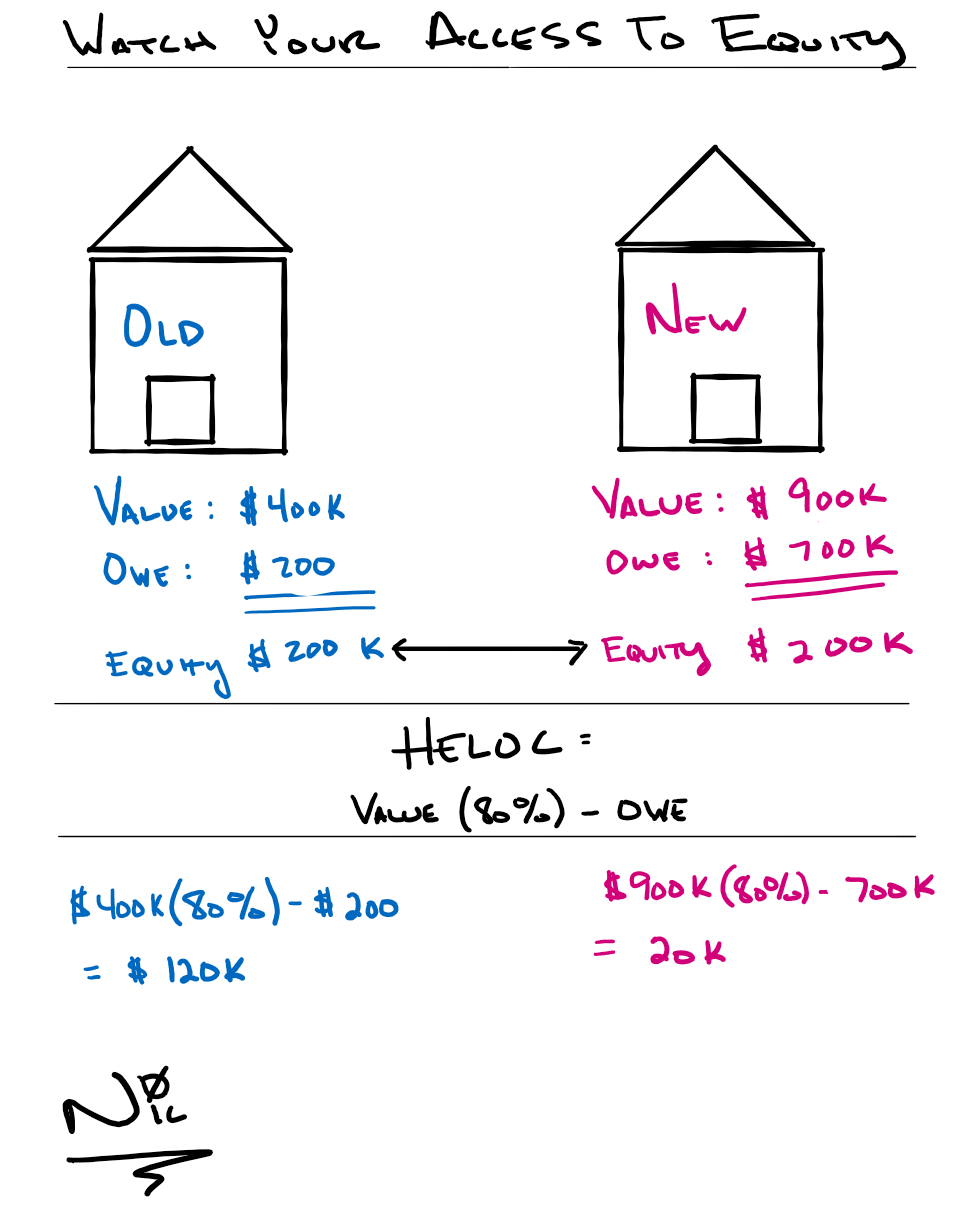

Be careful when moving to a new house because it could potentially impair your ability to get the same sized line of credit. If you are using a HELOC as an emergency fund, you might need to build a traditional emergency fund before moving to the new house.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.