Let’s talk about the elephant in the room: Everyone (almost everyone) was quick to share their 2023 doom & gloom prediction around this time last year.

A recession was “imminent,” and most investment outlooks for a rough year.

Well, if you based your investment decisions upon those predictions and economic forecasts, wow, 2023 was most likely a frustrating year for you.

While the investment community was busy spouting information about I-Bonds, Treasury Bills, Cash Alternatives, & Alternative Investments, the stock market did its thing and eventually marched higher.

At the time of this writing, the S&P 500® is up more than 23% year-to-date.

Basketball & Financial Planning

I am reminded of my high school basketball coach, Gene Miiller. He’s won multiple Indiana high school basketball state championships and has been enshrined into the IHSAA basketball hall of fame.

He believed in conditioning and preparation. In fact, his conditioning was so grueling that NCAA Division I college basketball coaches would come to witness it for themselves.

They weren’t there to recruit prospective student athletes, but rather to see what Coach Miiller was doing to prepare his athletes for the upcoming season.

He made sure practices were so challenging that his players were prepared for anything that happened on the court. And on the court, he won.

How did that success show up in games? For one, his teams were able to maintain momentum and synergy by not giving opponents time to regroup.

Coach Miiller rarely called a timeout during a basketball game.

How?

He had a plan. His players were conditioned to keep going and they knew what to do.

What does this have to do with me?

Everything!

Just like Coach Miiller having a plan to prepare his players for the challenges of a grueling season, we have a financial plan for our clients.

Our job is to prepare you to endure the ups and downs of a grueling season.

Will 2024 will bring some predictable obstacles, of course it will:

☐ Presidential Election

☐ More recession chatter

☐ Interest rate predictions and reactions

☐ Geopolitical strife

Along with another half-dozen obstacles that we can’t predict.

The Election

If 2020 is any indication of what lies ahead, the Presidential Election will be stressful, frustrating, full of new sensational headlines.

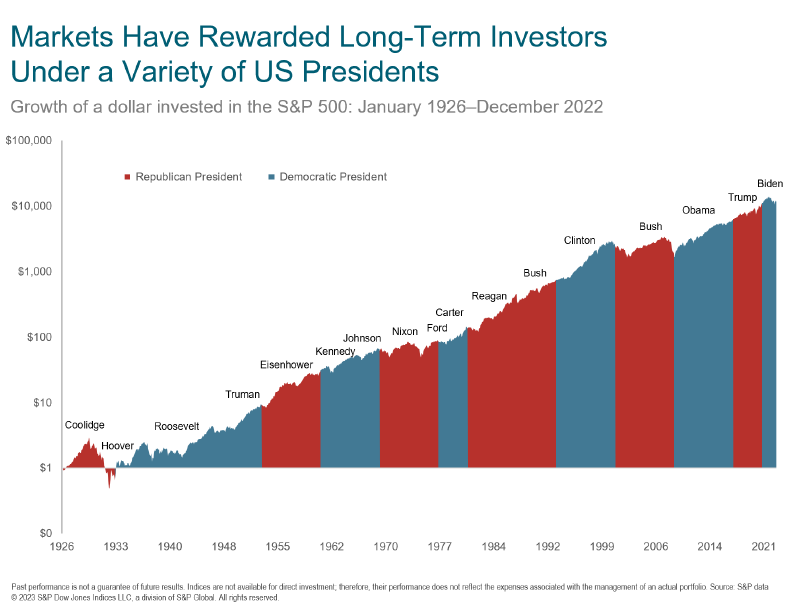

Take a second and check out one my favorite charts about how the S&P 500 has performed going back to 1926 (below).

Big Takeaway: It doesn’t matter what political party is in office, companies will do everything within their power to steward their capital towards profitable endeavors.

Another core belief of ours: We all win when we stick to our financial plan.

Acting Upon the Plan

As you’ve heard us say over and over: Your dreams, goals, and aspirations will determine your plan and your plan will determine your portfolio.

We closely adhere to the 6-5-4 Methodology.

☐ 6 months of cash set aside in an emergency fund

☐ 5 years’ worth of your portfolio income set aside in “fixed income” investments.

☐ The balance should be invested 4 “growth.” We emphasize the power of ownership in companies.

Returns Don’t Just Happen, They’re Earned!

There’s a cost of admission to earn the full return of the stock market. It requires endurance and patience:

- (Accept volatility) Historically, the U.S. stock market drops about 15% every year, and will

- drop 30% or more, about every 5 years.

- (Apply Patience) The historic long-term return of being an investor in the U.S. stock market is 7-10% annualized.

In fact, the worst 30-year rolling return of the S&P 500® on record is 7.8% per year.

Real numbers: That’s turning $100,000 investment growing to a whopping $951,837 in 30 years.

*Past performance is not indicative of future results*

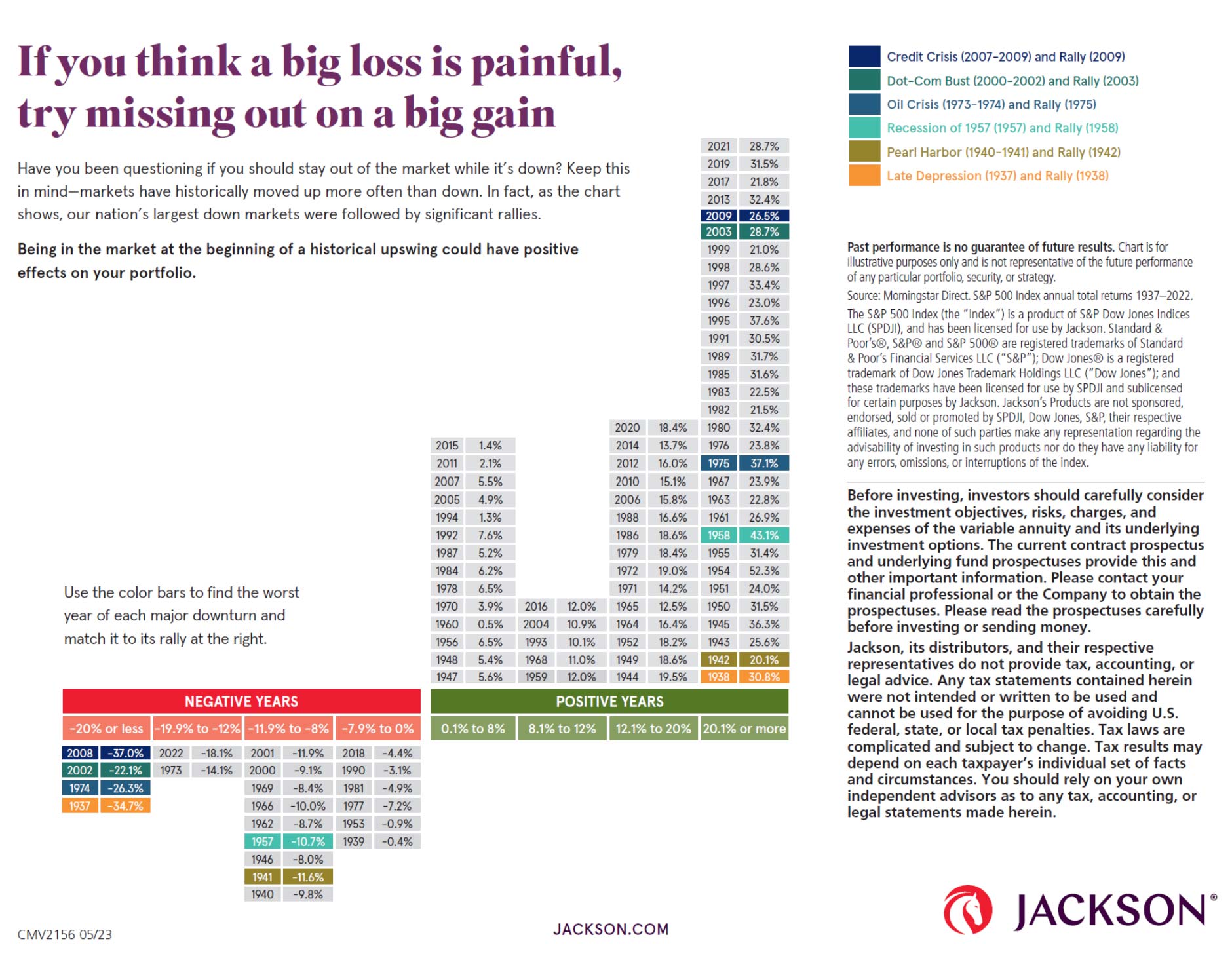

Returns are Lumpy

The financial planning community has done a great job of highlighting the long-term 7-10% annualized return (described above), me included.

However, this sets unrealistic expectations.

As you’ll see below, between 1937 and today, the S&P 500® has only had a 1-year annualized return between 7 & 10% one time!

☐ 7.6% in 1992

Conclusion

Why don’t we make predictions about what will happen next?

Because EVEN IF we knew ALL the economic data that were to come out in 2024, we couldn’t do much with it because we have no idea how the markets would react to it.

Remember Coach Miiller – instead of trying to forecast the future flow of the game (or stock market), we’d rather focus on our plan so that regardless of what happens, we’ll be prepared for it.

These emails, our annual reviews, and our ongoing conversations are your “conditioning” that will prepare you to win throughout the grueling season that lies ahead.

Hold tight to the plan.

Faith. Patience. Discipline.

If you or someone you’re close to could use help aligning their finances and establishing a financial plan, please reach out to us, we’re accepting new clients and eager to help.

Cheers,

Nic

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Investing is subject to risks including loss of principal invested. Past performance is not a guarantee of future results. No strategy can assure a profit nor protect against loss. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice.