As I write this message, the S&P 500 is currently at 3,997. A quick Google search tells me that the S&P 500 has been between 3,491.58 and 4,637.30 during the past year. We are about as close to the midpoint, halfway, as you can be.

What happens next?

How do we plan for the future?

Trying to prognosticate what the stock market will do from day to day or year to year is a fool’s game.

We are not the smartest wizards in the room, nor do we have a crystal ball.

As financial planners, we focus on returns over meaningful time periods.

We believe that a meaningful time period is 10 years or longer.

Over longer periods of time, the U.S. stock market tends to move in correlation with corporate earnings.

Fun fact: did you know that companies in the S&P 500 made MORE money in 2022 than in 2021 [you probably won’t hear that tidbit in the news].

There is a lot of pessimism about the economy and the stock market right now.

Keep the faith!

We are optimistic that the world is so pessimistic. Following the herd can be dangerous.

As long-term goal-driven investors, we need to focus on what we can control [we certainly cannot control the day-to-day movement of stock prices].

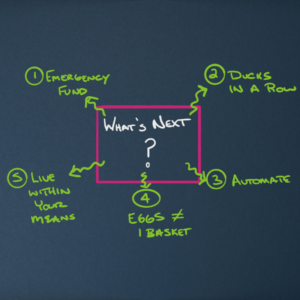

What is in your control today?

1/ Have an emergency fund

2/ Make sure your ducks are in a row (estate planning, life insurance, disability insurance, long-term care, home equity line of credit, etc…)

3/ Have an automated investment plan (how much to invest, where to invest, and what to invest in)

4/ Don’t put all your eggs in one basket (own a diversified portfolio of low-cost investments)

5/ Live within your means

Did You Know: Between 1950 and 2020 the worst the S&P 500 has performed over a rolling 20-year period is +6% per year.

$100k growing at 6% over 20 years is worth $320,713.54.

Trendline inflation growing at 3%, turns $100,000 into $180,611.12 over the same 20 years.

This is why we invest!

If any of your friends or family have financial questions, we are happy to be a sounding board for them. If they are important to you, they are important to us.

–Nic & Jeff

We are a full-service financial advisory company that allows you to make a one-page plan for your money and prepare for your future. Learn more about what we do and how we can help you here.

___________________________

*Please note that I reference the S&P 500 as a proxy for the U.S. Stock Market. The S&P 500 cannot be invested in directly.*

*Past performance is not indicative of future results.*

*Diversification does not guarantee against loss.*