Everyone loves getting a great return on investment. The market can provide some ups and downs along the way, and all in all, a well-diversified portfolio can shield you from some downside risk. However, don’t expect parabolic returns either.

Up, up and away!

Sometimes clients want to take a piece of the pie and speculate. You hear that Tesla is a good investment or some new pharmaceutical is the next big thing. Assuming other boxes get checked, we have no problem taking a small percentage of your overall portfolio to use on the side.

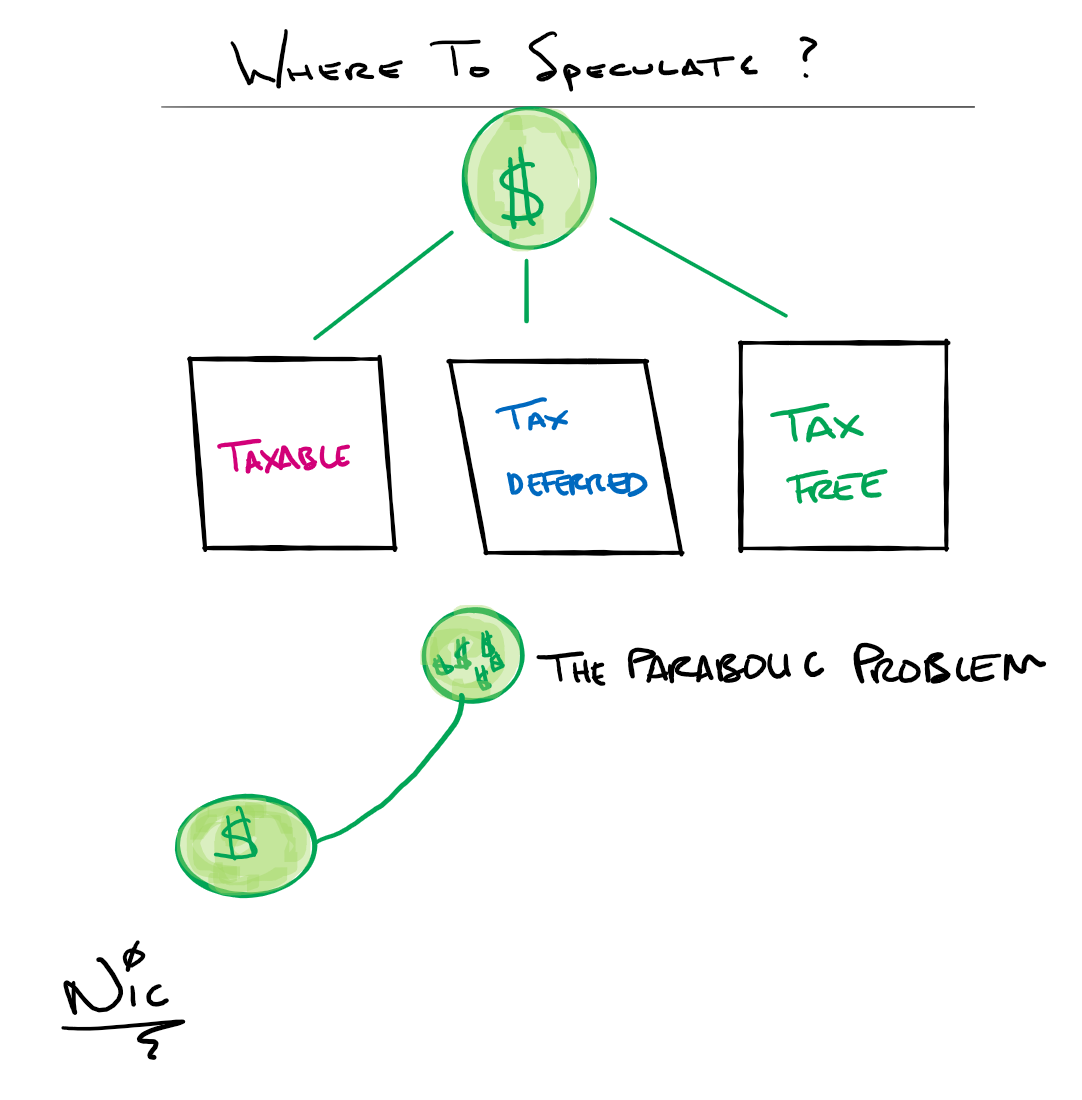

Let’s say you want to speculate with a portion of your portfolio. Let’s assume you get the desired result and get a parabolic return (for example, you turn $10k into $300k). Where should this speculative position be in your portfolio? Probably not your taxable account.

If your bet pays off, you want to keep as much of the gain as possible.

- Taxable Account – You will pay capital gains upon selling the security

- Tax-Deferred – You create a tax bill for a future date

- Tax-Free – Inside of a Roth IRA or a Roth 401(k), selling a profitable investment will not trigger a tax bill as long as the funds remain in the Roth account.

Roth, Roth Baby

Clearly, the Roth side of things is where you want your mega-returns to stem from, if possible. Since Roth 401ks are limited by your employer typically to a handful of mutual funds, you are unlikely to experience the moon-shot gains here.

You might consider a Roth IRA if your goal is speculation. With a Roth IRA, you have a world of investment opportunities that you’d not typically have in a Roth 401k. However, it’s always wise to double-check your Roth 401k at work to see if you have a brokerage window that allows for investing in individual securities within your Roth 401k.

Important Information

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decisions.

A Roth account offers tax deferral on any earnings in the account. Qualified withdrawals of learning from the account are tax-free. Withdrawals of earnings prior to age 59 1/2 or prior to the account being opened for 5 years, which is later, may result in a 10% IRS penalty tax.

All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.