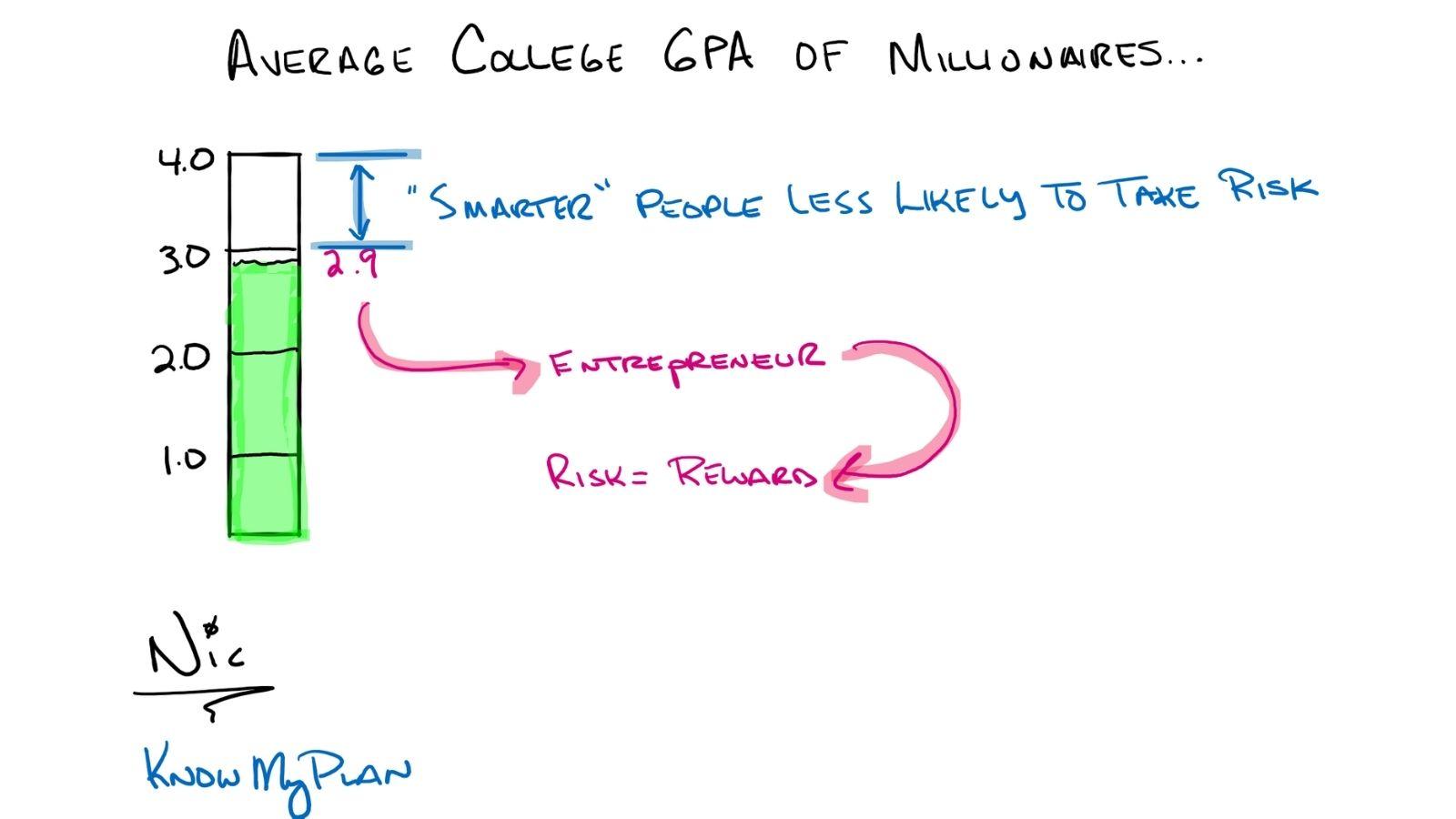

According to the book “The Millionaire Mind,” the average college GPA of a millionaire was 2.9.

They found no statistical correlation between economic productivity and academic performance.

“Smarter” people tend to take less risk.

However, the entrepreneur tends to have more of a risk-taking mindset, leading to statistically more entrepreneurs reaching millionaire status.

Risk-reward and time in the market

There is an old saying, “the A students work for the B students. The B students work for the C students, and the C students own the company.”

While this is not always the case, there is much truth to be found here. Don’t ever let anyone tell you that you can’t be successful without a college degree or a low GPA. Also, C’s get degrees.

The Millionaire Next Door (the first book in the series, written by the same author as The Millionaire Mind) notes that many millionaires are blue-collar business owners. They may have a favorable niche or know-how but on average they are pretty frugal. Above all, they’ve done a great job at putting their hard-earned money back into investments over long periods. It is not uncommon for a large chunk of millionaires to have never broken six figures of income!

What about education, surely average GPA counts for something?

Seth Godin did a fantastic TED talk on the origins of our education system in America. He notes the Industrialist’s approach in creating the education system was to increase the number of people working in factories. To clarify, there was a labor shortage and need to fill the demand for workers. The modeled the classroom setup to that of a factory line. The result was less passion for learning and more obedience. In short, a lot has stayed the same in that colleges continue to crank out workers, not entrepreneurs.

Most schools do not have many programs or emphasis of study on entrepreneurship. It may be changing now, especially with the rise of online education and the ballooning cost of college. These massive costs are driving people to reconsider a four-year degree and look for alternatives.

Whether it be trade school, online courses for specific knowledge like coding programs, or even YouTube, the world is changing. Gone are the days of your parents formula for success: Going to college. Getting good grades. Finding a stable job with a pension, and working until 65. Thankfully.

Thinking through college planning, retirement planning or using your money to live life on your terms? We can help! Click here to setup a free 30 minute call to see how we can help.

Source: https://www.theladders.com/career-advice/4-things-millionaires-have-in-common-backed-by-research

Source: https://www.youtube.com/watch?v=sXpbONjV1Jc