Paying for college is high on our client’s priority list. College planning is so essential to some that people often neglect their retirement savings to prioritize saving for college.

While we do not advise that clients prioritize college over retirement, it’s easy to understand the importance of college planning in people’s lives.

Sticker shock

Higher education expenses continue to be one of the fastest-rising costs in America. Currently rising at 6% annually, it doubles historical inflation. The College Savings Plans Network estimates that sending a toddler in 2021 to an in-state public school, including tuition, fees, room & board, would cost $261,277. If you can stomach private college, the bill expands to $598,063.

So How Do People Afford To Send Their Kids To College?

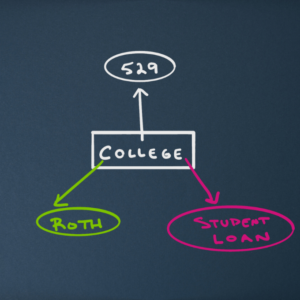

With rising expenses and eye-watering rates in the future, it might feel like you need to rethink college altogether. Thankfully you can combine two powerful tools in tax-advantaged college accounts.

First, these accounts give you a break on taxes, assuming you play by the rules. Secondly, you can have the power of compound interest working to grow these tax-advantaged dollars to help you maximize your money.

Regardless of the vehicle, you use to save these dollars, please know that time is your greatest asset. Start today. Getting the funds invested asap allows the optimal time for compounding to do its thing, allowing you the maximum amount for higher education. One quick tip for any over-achievers reading this that might not even have kids. You can get some of these accounts like the 529 in your (yes, you) name and then change the beneficiary once your child is born and you have a social security number.

The Main Tools In Your College Planning Arsenal

A carpenter needs more than just a hammer to build a house. Likewise, everyone’s college planning goals are different, so there is not one catch-all solution. Thankfully there are multiple account types, and each has its pros and cons.

The 529

Probably the most popular girl at the dance and the first thing people think of when looking to stash some cash for college. To start, the 529 works very similarly to your Roth 401k or Roth IRA on the principle of potential tax-free growth. You put in some money, assuming you follow the rules, it grows tax-free, and when you use those dollars for qualified expenses, they come out tax-free.

One of the notable features of the 529 is the higher contribution limits. In 2022 that limit per individual is $16,000. Another nice feature is the ability to supercharge five years of giving upfront. Wealthy Uncle Rico can drop $80K into the account if he doesn’t add anything extra for five years. Something to keep in mind when you are building out your Christmas wish list.

Why we dig it:

- Tax-free growth

- Higher contribution limits than other plans

- Investment flexibility (depending on the state-specific plan)

- You can start a plan in your name before having kids and change the beneficiary once Junior gets a social security number.

- The assets in the plan won’t negatively impact your ability to receive financial aid via the FAFSA.

What we don’t love:

- Each plan limits investment options.

- If you take money out for expenses that aren’t qualified, you’ll get hit with a 10% penalty and owe income tax on the distribution.

Brokerage Accounts

A brokerage account is a catch-all term for an account at a brokerage firm. Think of it as a checking or savings account, though instead of holding just dollars, it can have stocks, bonds, mutual funds, ETFs, etc.

It is worth noting upfront that there are 0 tax benefits to saving for college in an account like this, though it does have a role in this conversation. You’re likely concerned with things that affect your children outside of college planning if you are reading this. A brokerage account is an excellent place for other things like saving for a car, braces, weddings, and goals. Sure, you can have some dollars earmarked for college as well.

Why we dig it:

- Ultimate flexibility. It is your money, and there aren’t any tax hoops to jump through. Put in as much or little as you want.

- Ultimate investment options. You aren’t limited here either. If you want to put all your kid’s college money in TSLA, good luck. (Obviously, we do not recommend you do that).

- There are no restrictions on how to spend it. Again it’s your money, so if you want to use it for your child’s laptop, housing expenses, burrito allowance, go crazy.

What we don’t love:

- No tax break

- Some taxes will be due each year if the account has earnings. Also, there is a short-term or long-term capital gains tax to consider.

- Please don’t put it all in TSLA.

- Money in these accounts can negatively impact financial aid.

Roth Roth Baby

We are big Roth fans here at Know My Plan. You know, when it makes sense. This one is more of a life hack and riddled with stipulations and workarounds.

The ideal scenario: You are a professional photographer, you have a baby, take pictures of the baby and use them in your marketing material. Congratulations, Baby is now on the payroll, and you can put up to $6K in a Roth under Baby’s name, assuming Baby “earned” that much income in the same year. Again that’s a loose example and indeed a hypothetical one.

A more realistic one is that your kid turns 16 and gets a job at Chick-fil-a. You can put up to $6K in a Roth to help with college planning, assuming they earned at least $6K for that year. I’m perhaps beating a dead horse, but it has to be “earned income” for them to contribute to a Roth. They can make $6K at work, and Mom and Dad can fund the $6K, which is fine, but Junior has to have earned income.

The reason we all love a Roth is the tax-free growth. We say all the time, “Would you rather pay tax on the seed or the harvest?” The longer they can grow, the more powerful Roth dollars become, so we don’t always advocate for them for college.

With a few thousand dollars in early contributions, Junior could be looking at a decent retirement nest egg in the millions if he can just set it and forget it.

Why we dig it:

- Tax-free growth.

- A myriad of investment options.

- Access to the principal at any time without penalty.

What we don’t love:

- The child must have earned income.

- $6,000 max annual contributions.

- Roth dollars are more valuable the longer they are held, so we’d prefer them used for early retirement over college.

Custodial Accounts

Depending on your state, you have either the UTMA or UGMA. It refers to the Uniform Transfer/Gift to Minor’s Act. The short version is that you can put funds into an account under your child’s name, but it becomes there’s at age 18, 21, or 25, depending on which state you are in and the specific rules of the plan.

While it might sound nice, this is probably the worst option of all we have gone through. The main drawback here is a lack of control for the adults. We don’t love the idea of Junior turning 18 and using this to take a gap year on your dime.

Why we dig it:

- No contribution limits

- You can spend how you like as long as it’s for the child.

- Wide investment flexibility

What we don’t love:

- Weak tax benefits compared to other options

- Kids can turn 18 and blow through the cash

Wild Card – Real Estate For College Planning?

I label this one a wild card just because this falls typically in the active management category. Most people don’t want the hassle of learning to deal with real estate, get a down payment, find the property, etc. Sure, there are ways to find turn-key rentals. I may be getting ahead of myself here.

The rough concept would be to buy a rental property (for each child) and have the tenants pay down the mortgage so that, ideally, the house is mortgage-free by the time your child is ready for school. At that point, the mortgage-free cash flow can theoretically pay for their college.

That’s the short version. There are certainly a million variables at play, and while it is certainly a viable option and, depending on your situation, may be the best option. For most, it entails a lot more than clicking on “open your 529 account.”

College Planning Analysis Paralysis

With all these different accounts to choose from, it can seem overwhelming. Though everyone’s situation is different, the 529 is a great start. You can Google “(your state)+ 529” and land in a good area. In NC, the first link that pops up directs you to a place to open a 529 in a few clicks, with some target-date options to choose some Vanguard funds.

Getting started sooner than later is half the battle with college planning. Compound interest is your friend, and you want to let your money work as long as possible to compound and grow. In theory, the longer you wait, the more money you need to fund college. So, even if things are tight and you can only do a little each month, it’s worth considering setting the account up sooner rather than later and increasing the contribution over time.

A Note On Investing

Think of a 529 like you would a 401k. It is ill-advised to day-trade inside this account. Set it up, pick a target-date fund, or dial in your investment allocation (call us; we are glad to help) and set your auto-contribution and let the magic happen. Yes, you should check in from time to time, ideally auto-rebalance annually, but don’t micro-manage this. Indeed, don’t make changes because you got spooked while watching Mad Money.

Cutting Costs While College Planning

We’ve already established that saving for college is no joke. Prices continue to rise, so what’s a guy or gal to do?

AP

To continue the theme of planning, starting the college journey in High School is a great way to shave off some college credits. Front-loading your courses a year or two early can add substantial savings, assuming your young one is up to the task.

CLEP

The College-Level Examination Program (CLEP) is a great way to test out of classes and save some time and money. What if I told you your child could take a multiple-choice test that’s available for 34 subjects that cost approximately 1/10th of a college class, not to have to sit in the same class and pay 10x the price? Sounds pretty sweet, right? Indeed, it’s worth considering. Though, I get that all this extra study between AP classes and CLEP tests might make Jack a dull boy. Tread carefully, but this could be a game-changer.

Part-Time Employment

Many parents love the idea of their children sharing in the financial burden. A part-time job can be a great way to lighten the load, even if it means less beer money you have to Venmo them. Many on-campus jobs can help if your child doesn’t have transportation, and some can almost amount to getting paid to study! Everyone is different, and it can be challenging to juggle a full course load and employment, though many make it happen and learn some valuable skills in the process.

What does The US Military Have To Do With College Planning?

Uncle Sam wants to give you money for college. The Post 9/11 GI Bill is a massive benefit to our service members and can be why many young men and women join the ranks of our nation’s armed forces. There are many stipulations and red tape, but the GI Bill can fund your college plan and give you money for housing!

The biggest downside of this plan is that you will typically serve your country and then go to college. There are other programs for people to go to a Military Academy where the Military pays for college, and you serve for a few years post-graduation.

Each military branch has a school set up for this purpose with various majors. However, it isn’t for the faint of heart, as it combines college and elements of a boot camp environment. Still, it can be an excellent way for our best and brightest to get a great education while serving your country and leveling up your life and discipline significantly.

Our weekend warriors aren’t left out in the cold either. Reservists also have a GI Bill though the benefits are significantly less than those serving on active duty. However, it can be a viable way to kick-start your college experience.

Financial Aid

There is free money to be had when it comes to college. People are often surprised that many scholarships have surprisingly little competition. The FAFSA (link) is the gold standard and usually the first step in the process for families looking for some money. Scholars are available for almost anything, including being left-handed or tall. The rub is that they all require an essay to apply, so it isn’t as easy as just clicking a link and putting in your email to get paid.

Taking an inventory of your child’s skills, giftednesses, unique abilities, or even heritage can help guide your search in applying for scholarships or narrowing down on some to use.

Student Loans

Loans get a bad rap, and for a good reason. There is some predatory lending when kids can take out $300K for a Bachelor’s in Liberal Arts. Our kids need wisdom that their major should likely have some return on investment in most cases. If you aren’t able or choose not to foot the whole bill for college, please help your children navigate this landscape carefully. This is a one-way street, and if you take on six figures of debt and flunk out, it doesn’t magically go away.

Not to say that all loans are wrong or not worth it. We aren’t Dave Ramsey and will not shame you for considering this option. Frankly, we would love to be a sounding board and help you think through such a big decision. It can even be challenging to put best practices in an article as this is an individualized topic. It’s one thing to take on a significant debt burden if you become a neurosurgeon who’ll have the income to pay it back. Getting a job as an underwater basket-weaver with a big student loan payment is another thing.

Putting a bow on it

Saving for college is no small undertaking. It can require years of planning, saving, investing, and sacrificing to send your kids away to school.

For most parents, a one-size-fits-all approach is sub-optimal. We typically recommend that people do not just pour all excess cash into a 529 and call it a day.

As with most investing, diversification is the name of the game. We are big fans of diversifying amongst asset classes and asset locations, and we don’t think all of your dollars should be in a traditional 401k. You likely need multiple vehicles for college savings.

Even the parents who are most adamant about their kids going to college may be surprised if one of them flunks out or finds an alternate path, leaving you with excess capital in a college fund. Sure, worse things can happen, but we want you set up for optimal success!

Having your kids have a Roth, a 529, and you having a brokerage account to fill in some gaps can go a long way to a more optimized, albeit counterintuitive, approach.

Let Us Help

If we can help with any specific questions or are ready for your free one-page plan, please click the link here to schedule a complimentary call.

Please discuss your specific situation with the appropriate professional prior to investing. All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.