So you keep hearing about this whole ‘Financial Independence’ thing. You like the idea of work is optional, or at least having more funds for emergencies and maybe even retiring early or downshifting to a less stressful job.

One way is to invest early and often into an investment vehicle with a history of positive performance that is in line with your risk tolerance. So the more you can invest per month, the quicker you can work towards your goal. Easy enough, right?

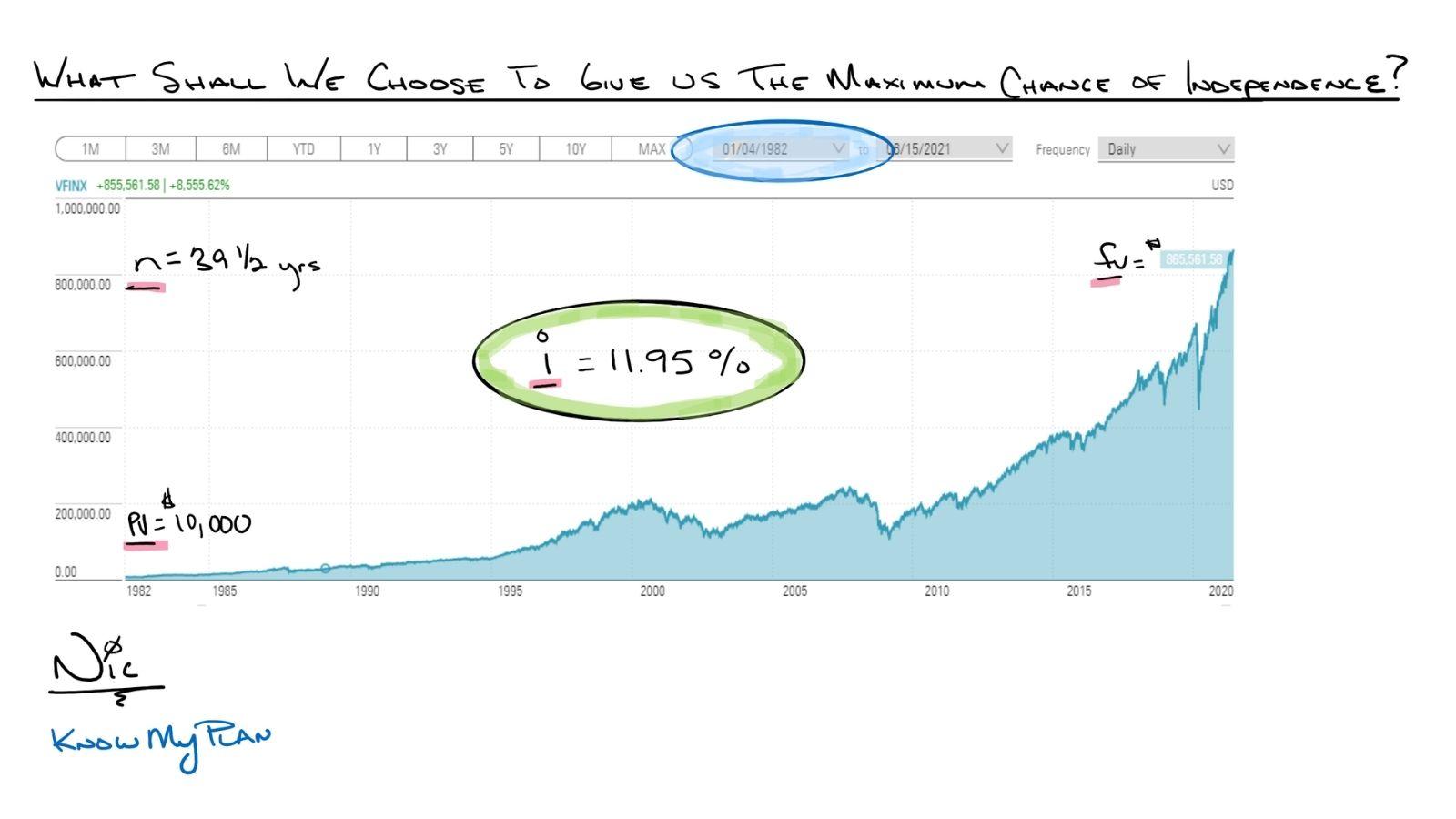

With all the swirls and shiny objects, it can be challenging to know where to invest. Thankfully we have the S&P 500 as an example.

Isn’t an index boring?

Over the past (almost) 40 years, the S&P 500 has been an exceptionally good place to build wealth. During this 39.5-year period, the average rate of return is 11.95% per year.

According to JP Morgan’s Guide to The Market, the S&P 500 has averaged an 11.3% rate of return from 1950-2020.

The worst 20-year rolling rate of return was 6% per year (the best was 17%).

Therefore, I feel very comfortable building my plan around the potential of a 6% rate of return and being optimistic for more!

Boring is beautiful

For comparison’s sake, if you were making $100,000 and saving 10% or $10,000 annually, let’s look at an example. In the first scenario, you save in a savings account for 40 years, and let’s be generous and assume the account gets 3% on average over 40 years. Saving $10,000 for 40 years would get you $753,710 in retirement.

In our second scenario, let’s look at what it would look like if you could get that same 11% return that’s happened over the last 40 years. If you invested the same $10,000 a year for 40 years and got an 11% return, it would be $5,815,933.36 at retirement! That is a difference of $5,062,223! Again this is an extreme example, and to be more conservative, we typically would use something more like the 6% example.

The point is where you invest matters, and we believe in consistently investing in a broad and diversified portfolio in the long run. We can help you reach financial independence!

— Nic & Jeff

We are a full-service financial advisory company that allows you to make a one-page plan for your money and prepare for your future. Learn more about what we do and how we can help you here.

_____________________